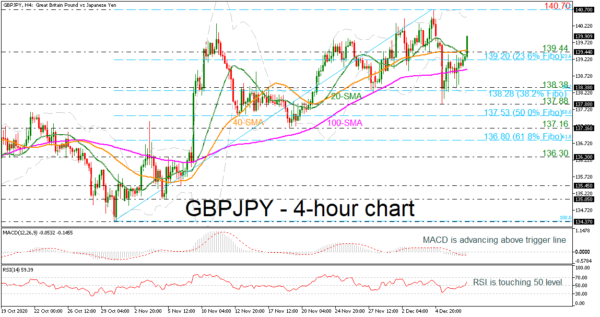

GBPJPY has been moving higher since the soft rebound on the 137.88 support, recovering losses made earlier this month. In the short-term, the market could maintain its upside move if the RSI keeps moving in the positive region, while the MACD is also surpassing its trigger line. Regarding the trend indicators, the 20-period simple moving average (SMA) is trying to gain some ground after the bearish cross with the 40-period SMA.

An extension to the upside could meet the area between the upper Bollinger band at 140.44 and the 140.70 barrier. Further up, resistance could run towards the 142.70 obstacle, taken from the peak on September 1.

On the other hand, if the pair weakens, the 139.44 line and the 23.6% Fibonacci retracement level of the upward move from 134.37 to 140.70 at 139.20 could provide immediate supports ahead of the 100-period SMA at 138.92. Even lower, the 138.38 level and the 38.2% Fibonacci of 138.28 could attract a greater attention as any leg lower could worsen the market’s outlook, opening the way towards the 137.88 hurdle and the 50.0% Fibonacci of 137.53.

To summarize, GBPJPY looks slightly bullish in the very short-term, while in the medium-term the picture is seen positive unless the price breaks below the 61.8% Fibonacci of 136.80.