Key Highlights

- USD/CHF started a steady decline below the 0.9120 and 0.9100 support levels.

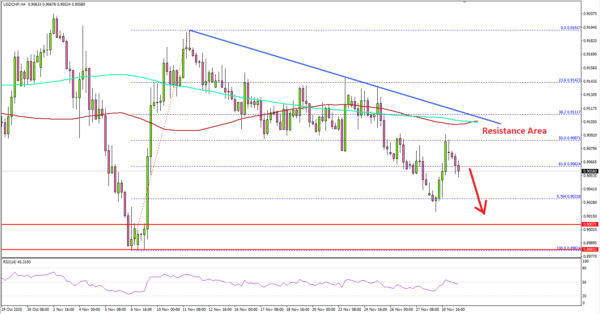

- A major bearish trend line is forming with resistance near 0.9105 on the 4-hours chart.

- EUR/USD surged above the 1.2000 resistance level, gold price started an upside correction from $1,765.

- The US ADP Employment (to be released today) could change 420K in Nov 2020, up from the last 365K.

USD/CHF Technical Analysis

This past month, the US Dollar struggled to clear the 0.9200 resistance against the Swiss Franc. As a result, USD/CHF started a fresh decline below 0.9150 and 0.9120.

Looking at the 4-hours chart, the pair even traded below the 0.9100 support level. There was a close below 0.9100, the 200 simple moving average (green, 4-hours), and the 100 simple moving average (red, 4-hours).

The pair even tested the 76.4% Fib retracement level of the upward move from the 0.8982 low (formed on 2020.11.06) to 0.9191 high (formed on 2020.11.11).

USD/CHF is currently recovering, but it is facing a lot of hurdles near 0.9100. There is also a major bearish trend line forming with resistance near 0.9105 on the same chart. A clear break above the trend line resistance, 0.9120, and the 100 SMA could open the doors for a decent increase.

If not, there is a risk of more downsides below the 0.9040 and 0.9030 levels. The next major support is near the 0.9000 handle.

Fundamentally, the Swiss Gross Domestic Product report for Q3 2020 was released yesterday by the Swiss Statistics. The market was looking for a rise of 5.9% in the GDP compared with the previous quarter.

The actual result was better than the market forecast, as the Swiss Gross Domestic Product grew 7.2%. Looking at the yearly change, there was a drop of 1.6% in the GDP.

The report added:

Domestic demand and parts of the service sector recovered significantly, while international developments had an adverse impact on exports.

Overall, USD/CHF could extend its decline unless it surpasses 0.9120. Looking at EUR/USD, the pair gained momentum above the 1.2000 resistance. Besides, GBP/USD managed to climb above the 1.3400 resistance. Gold price also started a short-term upside correction from the $1,765 support.

Upcoming Economic Releases

- German Retail Sales for Oct 2020 (MoM) – Forecast +1.2%, versus -2.2% previous.

- German Retail Sales for Oct 2020 (YoY) – Forecast 5.9%, versus 6.5% previous.

- US ADP Employment Change for Nov 2020 – Forecast 420K, versus 365K previous.