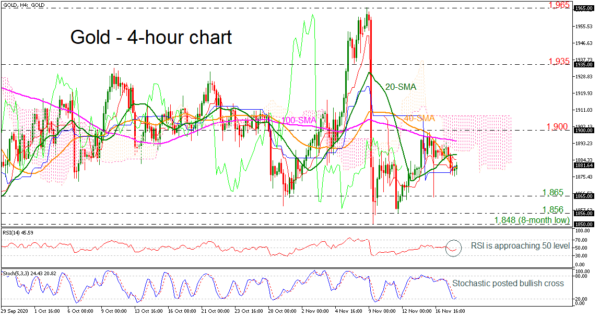

Gold prices are in a declining mode after the selling move below the 1,900 psychological level on November 13. However, the technical indicators are suggesting an upside pullback in the short-term. The RSI is pointing up approaching the 50 level, while the stochastic created a bullish crossover within the %K and %D lines near the oversold zone.

If the price ticks higher, immediate resistance could come from the 20-period simple moving average (SMA) at 1,887 ahead of the lower surface of the Ichimoku cloud at 1,889. Climbing above these levels, the 100-period SMA at 1,894 could be the next target before touching the crucial 1,900 barrier. Above that, the upper surface of the cloud at 1,907 could attract attention.

On the flip side, if the yellow metal drops lower again, it could meet the 1,865 support, taken from a strong spike. The bears could send the price until 1,865 and the eight-month low of 1,848.

Summarizing, gold prices have been in a neutral mode over the last two months and in a bearish structure in the very short-term.