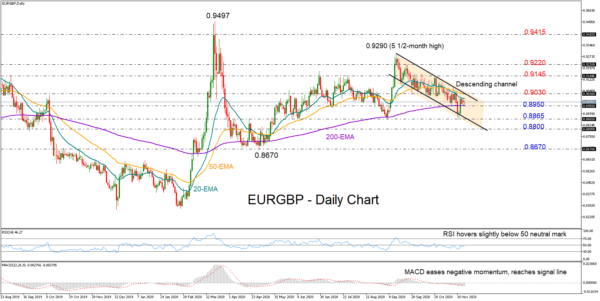

EURGBP remains stuck between the 20- and 200-day exponential moving averages (EMA) and the 0.8900 territory following the rebound at the bottom of a tight descending channel last week.

The momentum indicators reflect a bearish-to-neutral risk as the RSI continues to hover slightly below its 50 mark and the negative MACD is set to deviate above its red signal line.

A decisive rally above the channel’s upper boundary currently seen at 0.9030 would be ideal to develop positive sentiment and push resistance up to the 0.9145 barrier. A sharper upside correction could touch the 0.9290 peak if the 0.9220 hurdle proves to be fragile, while higher, the door would open for the 0.9415 crucial zone.

In the event the 200-day EMA gives way to the bears, the spotlight will shift again towards the bottom of the channel around 0.8865. A violation at this point could retest the 0.8800 round-level before a more aggressive sell-off brings the 0.8670 mark into view.

Summarizing, EURGBP is indicating a weakening bearish bias, where a bounce above the channel is expected to eliminate negative pressure.