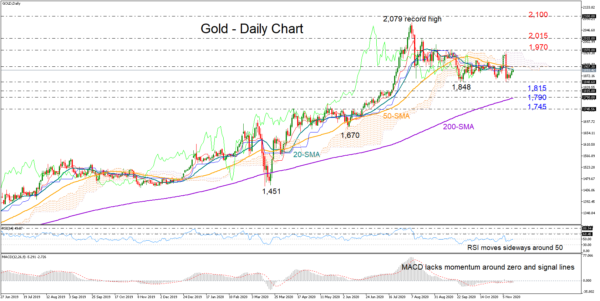

Gold has barely recovered last week’s sharp downfall that drove the price towards September’s low of 1,848, lingering slightly below its 20- and 50-day simple moving averages (SMAs) and the Ichimoku cloud.

The momentum indicators are currently painting a neutral-to-bearish picture for the short term as the RSI continues to lack direction and is marginally below its 50 neutral mark, while the MACD is also in a sideways move around its red signal line and within the negative area.

A sustained ascent above the 1,900 level and the 50-day SMA is probably what the bulls are seeking to stretch towards the upper surface of the cloud and the 1,970 resistance zone. Should they advance higher, the spotlight will initially shift to the 2,015 barrier and then to the record peak of 2,079.

Alternatively, a clear close beneath the 1,848 base would put the precious metal back in a downward path, justifying the active bearish cross between the 20- and 50-day SMAs. In this case, support may immediately commence within the 1,815 – 1,790 area, where the 200-day SMA is also heading. Diving deeper, the sell-off could next stall around the 1,745 number, which proved to be a tough obstacle from April to June.

Summarizing, the yellow metal is likely to maintain a neutral mode unless it crawls decisively above 1,900 or resumes its former downtrend below 1,848.