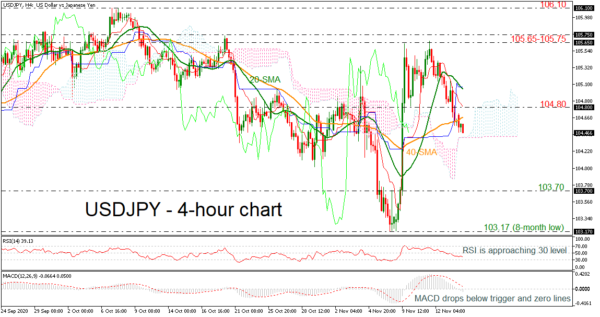

USDJPY is heading south after the pullback on the 105.65 resistance on November 11, sending the pair beneath the 20- and 40-period simple moving averages (SMAs). The red Tenkan-sen line dropped below the blue Kijun-sen line, suggesting more losses, while the momentum indicators are currently confirm the bearish structure. The RSI is pointing down in the negative territory, while the MACD declined below the trigger and zero lines in the short-term.

Immediate support could come from the lower surface of the Ichimoku cloud at 104.40 before meeting the 103.70 level, taken from the minor inside swing high on November 6. Steeper decreases could take the bears until the eight-month trough of 103.17.

Alternatively, a jump above the 40-period SMA could send the market towards the 104.80 barrier before flirting with the 20-period SMA around the 105.00 psychological mark. More gains could lead the price to rest near the 105.65-105.75 zone.

Summarizing, in the very short-term, the outlook for USDJPY is negative and may remain this way in the longer timeframe. A climb above 106.00 could switch the outlook to neutral.