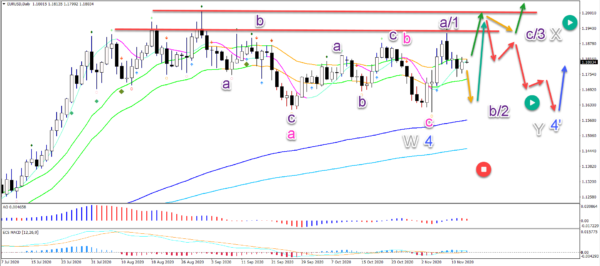

EUR/USD made a bearish bounce after breaking above the 21 ema zone. This is a key decision for either 1 more bearish swing or a bullish bounce.

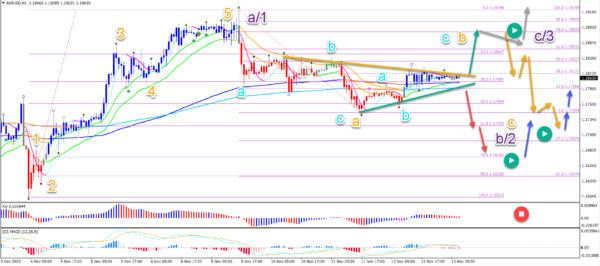

On the 1 hour chart, we see the price action completed a 5 wave pattern (orange). It was followed by an ABC down and an ABC up.

EUR/USD is now moving lower as part of a wave 2 or B. A bearish break indicates a deeper swing where a bullish bounce confirms the end of this swing.

This article reviews the Elliott Wave patterns and the expected price path of least resistance.

Price Charts and Technical Analysis

Eventually a bullish swing is expected to take place (green arrows). This will create either a wave 3 or C. Traders can see whether it’s a wave 3 or C depending on the pattern.

A bull flag (orange arrow) indicates an immediate break within wave 3

A reversal (red arrows) indicates a deeper pullback towards the long-term moving averages within an expanded wave 4’

On the 1 hour chart, we see the price action completed a 5 wave pattern (orange). It was followed by an ABC down and an ABC up.

Now the main levels to watch are the trend lines and 21 ema high and low.

A bearish breakout (red arrows) confirms a deeper wave C (orange) within wave 2 or B (purple)

A bullish breakout offers 2 scenarios:

It can confirm a deeper wave B (orange), which is followed by a 5 wave pattern in wave C (orange)

If a bull flag emerges (grey arrow), then an immediate uptrend can start