Netflix (NFLX) stock is testing the support zone again (green line). This is a key decision zone for a bullish break or bearish bounce.

This article reviews both bullish and bearish scenarios. And we dive into the expected Elliott Wave outlook, which is the same for both directions.

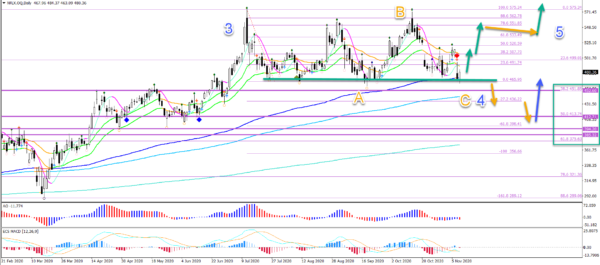

Netflix is in a bearish ABC (orange) pattern after completing a strong wave 3 (blue). Therefore, the current pullback is expected to be a wave 4 (blue).

Price Charts and Technical Analysis

Netflix is in a bearish ABC (orange) pattern after completing a strong wave 3 (blue). Therefore, the current pullback is expected to be a wave 4 (blue).

The main question is this: how deep will the wave 4 retracement go?

A bearish breakout below the support zone could indicate a decline that will test the Fibonacci retracement level.

A bullish bounce will indicate an immediate end of the wave 4 and the start of the bullish wave 5.

For the bulls to firmly take back control, they need price action to break above the 21 ema zone. Then price action must go sideways and stay above the 21 ema zone to confirm the continuation higher.

On the 1 hour chart, we can try to analyze whether the wave 5 (pink) of wave C (orange) has been completed. The key aspect to keep an eye on is this:

A bearish pullback that respects the previous bottom: bullish bounce is expected to take price back to resistance.

A bearish pullback that breaks the previous bottom: expect wave 5 to go lower.

The previous top (red line) is the main bull-bear line at the moment. A bullish break indicates that traders can expect a bullish price swing.