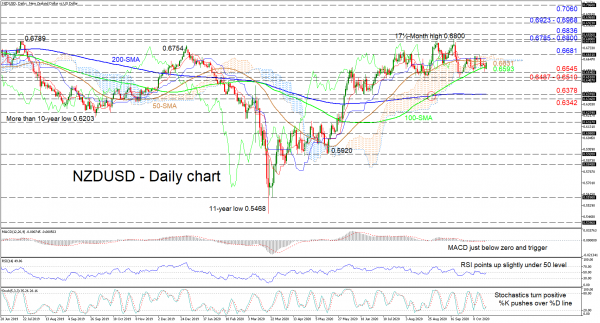

NZDUSD is currently trading in the vicinity of the 100-day simple moving average (SMA) and the red Tenkan-sen line, continuing to edge sideways, capped by the flattening 50-day SMA and Ichimoku cloud. The tone of the 50- and 200-day SMAs promotes a directionless market, while the 100-day SMA holds a positive course.

Dried up directional momentum is also reflected in the horizontal Ichimoku lines as well as the short-term oscillators. The MACD is located barely below its zero mark and its red signal line, while the RSI appears stranded, pointing up marginally below its 50 threshold. Yet, the stochastic %K line is improving, sponsoring advances with a push over the %D line.

Facing an upside scenario, the bulls would have to push past the 50-day SMA at 0.6631 and over the cloud, taking out the Ichimoku lines as well, before hitting the 0.6681 high. Climbing further, a tough resistance ceiling of 0.6785 – 0.6800 and the neighbouring 0.6836 barrier may challenge the ascent. Successfully surpassing these heavy obstacles, the price may then encounter another limiting area of peaks from 0.6923 to 0.6968, which span nearly four months, before the pair aims for the 0.7060 level.

If the price dips under the 100-day SMA at 0.6593, early friction may come from the 0.6545 mark and the key support section of 0.6487 – 0.6510. Should this important base fail to keep the upside structure intact, the pair may dive for the 0.6378 lows, fortified by the 200-day SMA. If this point fails too, the 0.6342 obstacle underneath may attempt to delay additional negative moves from unfolding.

Summarizing, a neutral-to-bullish bias may persist should the kiwi remain above the 0.6487 low. Moreover, the ascent from the 11-year low may be revived with a final break over 0.6800. However, a slip beneath 0.6378 may trigger negative worries.