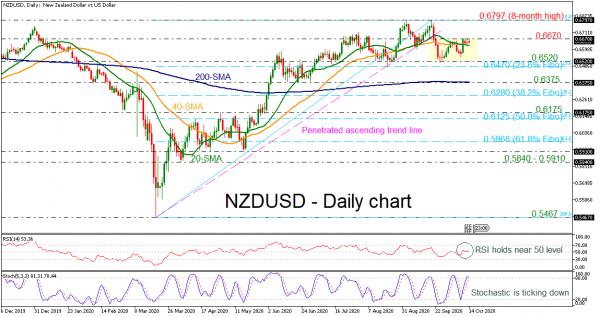

NZDUSD has been in a horizontal trajectory over the last three weeks within the 0.6520 and 0.6670 barriers. Currently, the pair is holding above the 20- and 40-day simple moving averages (SMAs) after they posted a bearish crossover in the short-term. The RSI indicator is sloping slightly up near the neutral threshold of 50, however, the stochastic oscillator is looking overbought as it is ready to create a negative cross within the %K and %D lines.

If the price manages to surpass the strong 0.6670 resistance level, the bulls could find a hurdle around the eight-month peak of 0.6797. Even higher, the 0.6940-0.6970 area could be crucial for traders as well, achieved in March 2019 and December 2018 respectively.

On the other side, a downside move could meet again the 0.6520 support and the 23.6% Fibonacci retracement level of the up leg from 0.5467 to 0.6797 at 0.6470. Breaching these lines, the 200-day SMA, which overlaps with the 0.6375 support, could come next.

In conclusion, NZDUSD has been developing beneath the ascending trend line, which had been holding since March 18, suggesting that investors may need a significant bullish rally for any positive actions.