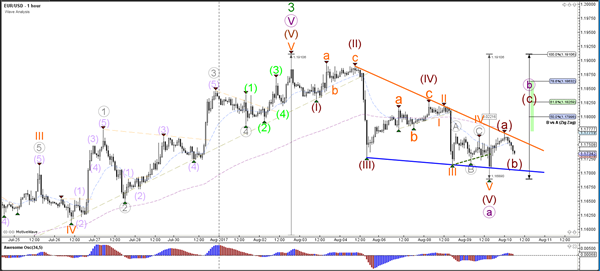

Currency pair EUR/USD

The EUR/USD bearish retracement bounced at the support zone (blue lines), which might indicate that the wave A (purple) retracement has been completed. The wave A is part of a larger ABC correction within wave 4 (green) which could fall towards the 23.6% Fibonacci level of wave 4 vs 3.

The EUR/USD broke below the support trend line (dotted green) and completed a wave 5 (orange), which in turn could complete a larger wave A (purple). Now price is building a falling wedge chart pattern, which is a bullish reversal pattern. A break above the resistance trend line (orange) would confirm the break and potential ABC (brown) correction within wave B (purple). A break below the support trend line (blue) could indicate a bearish breakout towards the 23.6% Fib at 1.16.

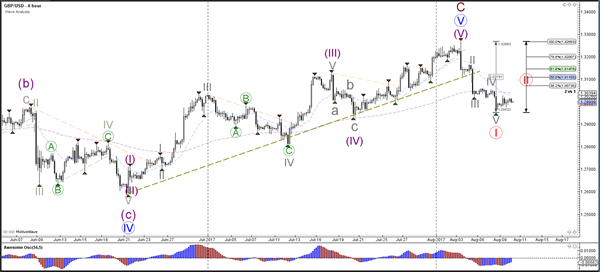

Currency pair USD/JPY

The USD/JPY is testing a larger support trend line (blue) from the daily support at 109.50. A bearish break could see price continue lower within wave C (brown).

The USD/JPY seems to have completed a potential 5 wave which could be a wave 1 (orange). A break below support (green) could indicate the continuation of the bearish trend.

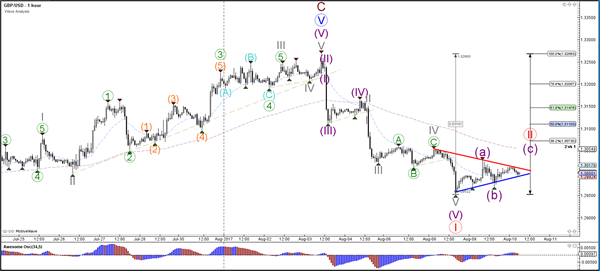

Currency pair GBP/USD

The GBP/USD seems to have completed 5 bearish waves within wave 1 (red). A bullish retracement could be part of a wave 2 (red).

The GBP/USD has support and resistance trend lines which could offer breaking spots for the Cable. A bullish breakout could a wave C (purple) develop whereas a bearish break could see the downtrend continue.