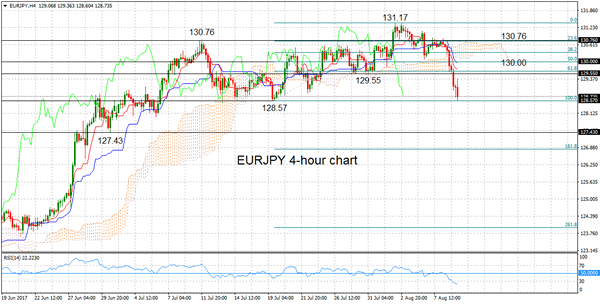

EURJPY is shifting from neutral to bearish on the 4-hour chart. Downside risk increased after the pair retreated from the multi-month high of 131.17 and fell below the key 130.00 psychological level.

The RSI indicator is giving a bearish signal since it has dropped below the 50 level and is sloping down. Furthermore, prices fell below the Ichimoku cloud and the negatively aligned Tenkan-sen and Kijun-sen lines are adding to the bearish view.

Immediate support lies at the July 19 low of 128.57. The price is approaching this level which if broken would result in a full retracement of the recent uptrend from 128.57 to 131.17. Following such a move, the outlook for EURJPY could turn increasingly bearish with scope to reach the next major low at 127.43 (June 30).

Only a move back above the 50% Fibonacci and key 130.00 level would weaken downside pressure for a move to 130.76 and 131.17. From this point, the longer-term bullish trend would resume. Otherwise, the short-term bias remains to the downside while the bigger technical picture would risk shifting from neutral to bearish.