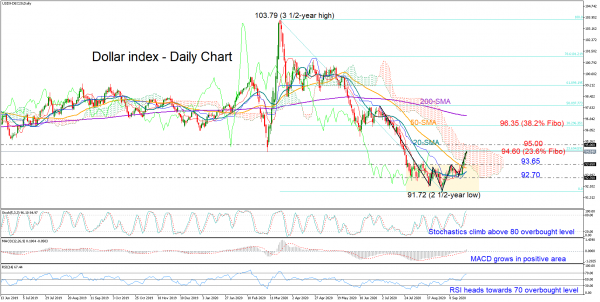

The US dollar index (futures) is finally showing signs of a trend reversal after a six-month period of depreciation that pushed the price as low as 91.72 from 103.79 in March.

Bullish pressures gained significant momentum this week, posting a higher high above the 93.60 resistance and the 20- and 50-day simple moving averages (SMAs) and hence, violating the downward pattern.

Some consolidation cannot be excluded in the near-term as the price is currently testing the 23.6% Fibonacci retracement of the recent bearish wave around 94.60 and the RSI and the Stochastics are hovering near overbought territory. That said, the rising MACD, which has recently jumped into the positive zone, is suggesting that upside pressures are still strong.

Should the 94.60 level give way, the price may need to stretch above the cloud and the 95.00 level to rally towards the 38.2% Fibonacci of 96.35. Such a move may come as further confirmation that an uptrend is in progress.

Alternatively, if the 23.6% Fibo rejects upside movements, the focus will shift back to the 93.65 area and the 50-day SMA, while not far below, the 20-day SMA currently at 93.00 could also act as a floor as it did last week. Lower, a close below 92.70 would eliminate hopes of a positive trend reversal, bringing the 91.72 trough next in sight.

Summarizing, the sell-off in the dollar index seems to have found a bottom and the market looks ready to build an uptrend. A break above 95 is required in order to confirm the continuation of the rally, though some consolidation cannot be ruled out in the near-term as the index is close to overbought waters.