Key Highlights

- Gold price declined sharply and traded below the key $1,910 support region.

- There was a break below a key triangle support at $1,945 on the 4-hours chart of XAU/USD.

- EUR/USD and GBP/USD extended their decline below 1.1700 and 1.2720 respectively.

- The US Initial Jobless Claims in the week ending 19 Sep, 2020 could decline from 860K to 843K.

Gold Price Technical Analysis

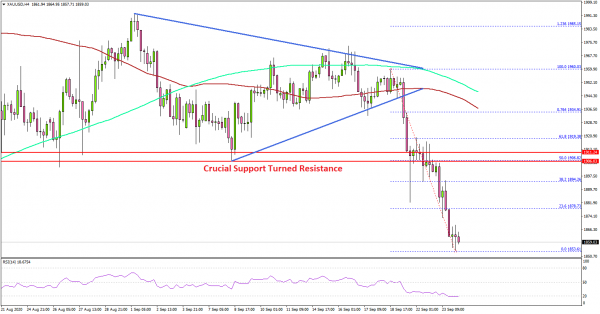

After struggling to clear the $1,960 resistance zone, gold price started a fresh decline against the US Dollar. The price broke many key supports near the $1,920 and $1,910 levels.

The 4-hours chart of XAU/USD indicates that the price started the recent decline after there was a break below a key triangle support at $1,945. The price settled well below the $1,910 support region, the 100 simple moving average (red, 4-hours) and the 200 simple moving average (green, 4-hours).

Finally, there was a break below the $1,900 support and the price traded to a new monthly low at $1,853. If there is an upside correction, the previous support near $1,900 and $1,910 could prevent gains.

On the downside, the $1,850 level is a decent support. If there is a break below $1,850, the price could continue to move down towards $1,820 and $1,800.

Fundamentally, the US Manufacturing Purchasing Managers Index (PMI) for Sep 2020 (Prelim) was released yesterday by the Markit Economics. The market was looking for a rise from 53.1 to 53.2.

The actual result was positive, as the US Manufacturing PMI increased to 53.5. Besides, the US Services PMI declined from 55.0 to 54.5 in Sep 2020.

Overall, gold price remains at a risk of more downsides. Looking at EUR/USD, the pair declined further below 1.1720 and 1.1700. Similarly, GBP/USD spiked below the 1.2720 support zone and seems to be following a bearish pattern.

Economic Releases to Watch Today

- German IFO Business Climate Index Sep 2020 – Forecast 93.8, versus 92.6 previous.

- US Initial Jobless Claims – Forecast 843K, versus 860K previous.