The Reserve Bank of New Zealand will wrap up its policy meeting at 02:00 GMT Wednesday. No action is expected, so the market reaction might depend on the overall tone of the statement, any changes to the timing of the next rate cut, and how open policymakers appear towards buying foreign assets. Economic data have deteriorated and the RBNZ’s own forecasts are grim, implying the Bank is likely to stick to dovish language, helping to keep a lid on the kiwi.

Shoot first, ask questions later

One can criticize the RBNZ for many things, but not doing enough during this crisis is not among them. The central bank has taken a ‘go hard and go early’ approach to boost the economy, under the logic that it is better to do too much instead of too little. It cut interest rates to near zero, signaled that it is open to negative rates, and launched a QE program so massive that it will likely swallow most of New Zealand’s bond market.

Under normal circumstances, all this would have ruined the kiwi dollar. But instead, the currency has plowed higher in recent months, powered by the risk-on mood in financial markets, a faltering US dollar, recovering commodity prices, and New Zealand’s successful containment of the virus.

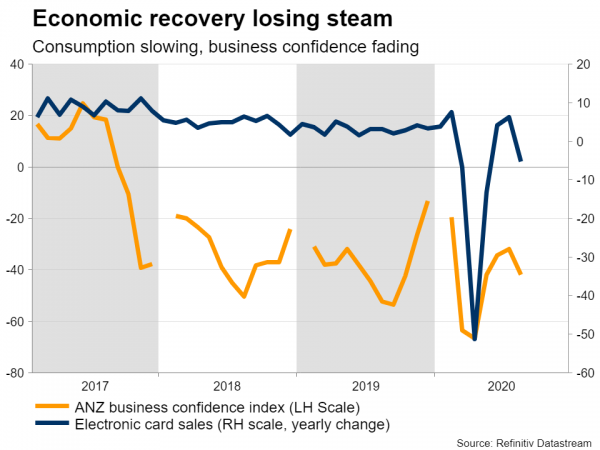

This is a headache for the RBNZ. A stronger currency is ‘bad for business’, especially if you are an export-heavy economy. It makes exports less competitive abroad and pushes down on the prices of imports, holding back inflation. In addition, recent data suggest the recovery is losing steam, with electronic card sales turning negative in the year to August and the manufacturing PMI taking a sharp dive, alongside business confidence.

All eyes on the guidance

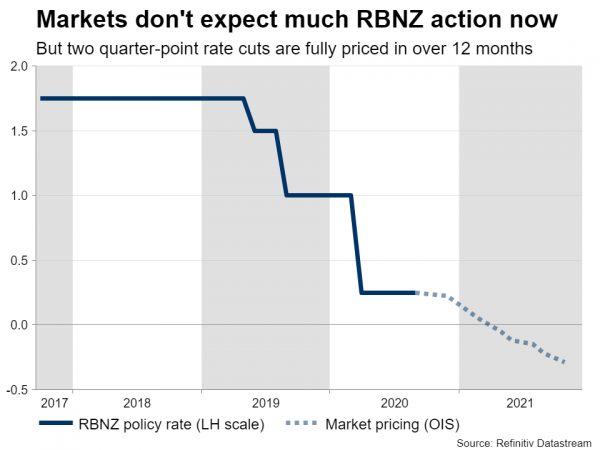

At last month’s meeting, the RBNZ ramped up its QE program beyond what investors expected and signaled very clearly – via its interest rate forecasts – that the next rate cut will come around March. Commercial banks need time to prepare for negative rates and the RBNZ also committed back in March not to touch interest rates for at least a year.

Money markets have now fully priced in a quarter-point rate cut by April, and another one to negative territory by October. Therefore, the RBNZ’s plans are well understood by the market.

So what will be the focus of this meeting? The spotlight will be on the guidance about next year’s rate cuts. Is it a ‘flexible’ commitment, allowing for a rate cut to come earlier in February for example, or not? Another topic will be any future changes to the QE program. How likely is the the RBNZ to buy foreign assets once it runs out of domestic bonds?

Market reaction

Admittedly, this meeting is unlikely to be a game changer for the kiwi either way. Any changes in language and guidance will probably be minimal, keeping the market reaction limited.

On the margin though, the scenario of a negative reaction seems more likely. Even though the Bank is unlikely to change its commitment to keep rates unchanged until March – as that would damage its credibility – it might still deliver a very dovish message. It could highlight the worrisome slowdown in recent data, reinforce its commitment to slashing interest rates to negative, and talk up the possibility of buying foreign assets if the situation worsens.

In the big picture, the RBNZ has already telegraphed most of its future moves, so the impact of policy decisions should be relatively modest from here. Instead, the kiwi’s primary driver might be the global risk mood, and specifically whether the latest correction in the stock market continues.

In addition, there’s an election coming up in New Zealand in less than a month. Of course, opinion polls suggest it will be a landslide win for incumbent Prime Minister Jacinda Ardern, so it might not generate much volatility.

Taking a technical look at kiwi/dollar, immediate support to further declines may be found near 0.6640, where a downside break could open the door for the 0.6600 handle.

On the upside, a move back above 0.6680 might initially stall around the inside swing low of 0.6755.