The dollar stands at the back foot in early European trading Friday after strong fall on Thursday.

Initial gains on Fed’s upgraded forecast for GDP growth evaporated as the green back came under increased pressure on downbeat US data on Thursday. Weekly jobless claims remained high and rose above forecast last week, while housing data figures fell below expectations in August, both pointing to persisting weakness in their sectors and warning of slowdown in economic recovery.

The greenback fell to the lowest in seven weeks vs Japanese yen and remains under pressure against the Euro and British pound.

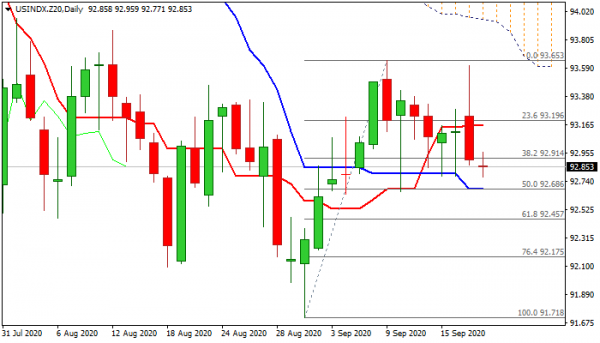

Dollar index daily chart shows weakening conditions, as Thursday’s bearish daily candle with long upper shadow signaled recovery is losing traction and weighs on near-term action, while return below a cluster of daily moving averages in 93.13/92.91 zone adds to negative signals.

Falling thick daily Ichimoku cloud maintains pressure as recovery attempts stalled twice under cloud base.

Fresh bears probe again below pivotal Fibo support at 92.91 and need close below here (after multiple failures) to expose next supports at 92.68/45 (Fibo 50% and 61.8% of 91.71/93.65 recovery leg), with break of the latter to signal an end of corrective phase.

Broken converged moving averages (10/20/30 DMA’s) reverted to resistance zone and only return and close above these barriers would sideline fresh bears.

Res: 92.91, 93.13, 93.42, 93.65

Sup: 92.68, 92.45, 92.17, 91.71