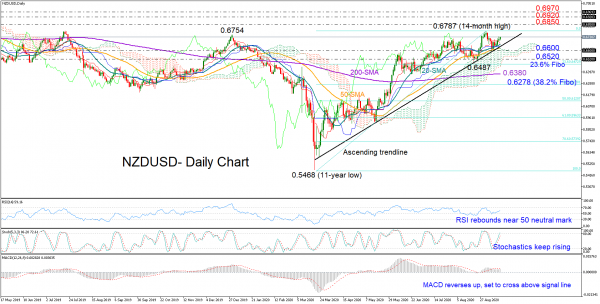

NZDUSD printed another higher low around the ascending trendline drawn from the March lows and its shorter-term simple moving averages (SMA), further strengthening its six-month old uptrend.

The positive slope in the RSI and the Stochastics, and the soft rebound in the MACD, which is set to cross back above its red signal line, suggest that there is more bullish action in store. The 20- and 50-day SMAs back this view too as the lines continue to point upwards.

Still, a rally above the 14-month peak of 0.6787 is required to upgrade the bullish outlook and open the way towards the 0.6850 former restrictive region. Moving higher, the pair may next pause somewhere within the 0.6920-0.6970 area.

To the downside, sellers should clearly breach the supportive trendline around 0.6600 to take full control and retest August’s bottoms registered between 0.6520 and 0.6487. This is also where the 23.6% Fibonacci of the 0.5468-0.6787 upleg is placed. Falling below the cloud, the flattening 200-day SMA may add some floor at 0.6380, stopping the price from reaching the 38.2% Fibonacci of 0.6278. In this case, the medium-term outlook would switch from positive to neutral.

In brief, NZDUSD seems to have more room for improvement in the short-term. Yet only a decisive close above the 0.6787 top could bring new buyers into the market.