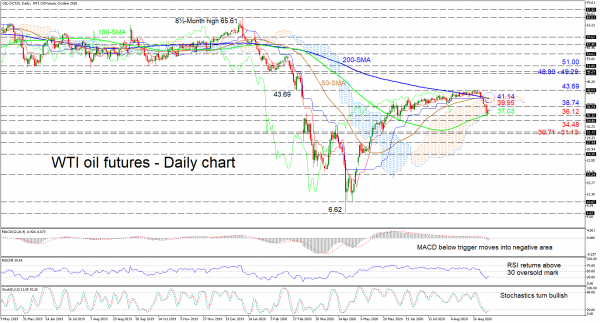

WTI oil futures have found some footing on the 100-day simple moving average (SMA) of 37.03, residing at the Ichimoku cloud’s lower band, following ineffective efforts to overrun the vital resistance border of 43.69. The flat Ichimoku lines and the converging SMAs appear to signal oxygen deprived directional momentum, which could nudge the price sideways.

That said, the short-term oscillators also display conflicting signals in momentum. The MACD is extending negative momentum below its red trigger line and the zero mark, while the RSI tries to maintain its return above the 30 level. Furthermore, the stochastic oscillator has turned bullish, promoting further advances. Nevertheless, the pullback is a significant move as the last time the MACD and the RSI moved into negative territory was back in early May.

Should the recent pullback below the 200-day SMA persist, immediate support may arise from the reinforced 100-day SMA – coupled with the lower boundary of the cloud – ahead of the adjacent 36.12 fresh low. Moving beneath this, the neighbouring 34.48 key barrier from June 12 may impede the price from challenging the support section of 31.13 to 30.71, relating to the troughs at the end of May.

If buying interest intensifies, early constraints may arise from the 38.74 obstacle ahead of the Ichimoku lines at 39.95 and the merged 50- and 200-day SMAs, at the cloud’s ceiling of 41.14. In the event buyers manage to clearly violate the toughened 43.69 hurdle, the price may rally towards the 48.80 – 49.29 resistance trench, before targeting the 51.00 handle.

Summarizing, oil’s short-term picture reserves its positive demeanour above the 100-day SMA and the 34.48 trough.