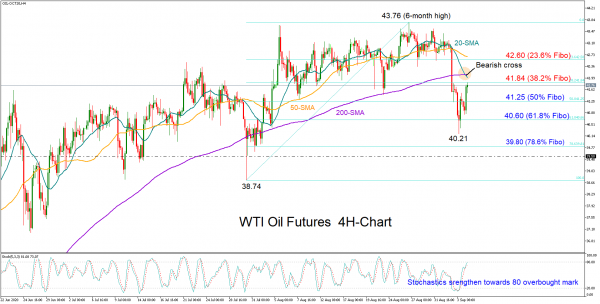

WTI oil futures for October delivery are healing after crashing below the 200-period simple moving average (SMA) on the four-hour chart and to a one-month low of 40.21 on Thursday.

While the fast Stochastics have yet to enter the overbought territory, suggesting that there is some room for improvement in the near-term, the 20- and the 200-period SMAs have just completed a bearish cross for the first time since January, giving a negative warning about the strength of the market’s upward pattern.

The area around the 38.2% Fibonacci of the 38.74-43.76 upleg at 41.84 curbed upside corrections on Thursday and could reject them once again if the bulls pick up steam. Crawling above that barrier, the price should sustain strength above the 200-period SMA to reach the 23.6% Fibonacci of 42.60. A violation of this point could resume confidence in the uptrend.

If sellers dominate, the 50% Fibonacci of 41.25 could prevent additional declines towards the 61.8% Fibonacci of 40.60. Lower, the area between the one-month low of 40.21 and the 78.6% Fibonacci of 39.80 could increase the case of a down-trending market if it fails to hold.

In brief, although WTI oil futures are trying to gain ground following the recent slump, trend signals suggest that the broader upward pattern may be losing steam.