Key Highlights

- Gold price started a fresh increase from the $1,920 support zone.

- There was a break above a crucial bearish trend line at $1,945 on the 4-hours chart of XAU/USD.

- Both EUR/USD and GBP/USD traded to new multi-week highs.

- The US ADP Employment could change 950K in August 2020, up from the last 167K.

Gold Price Technical Analysis

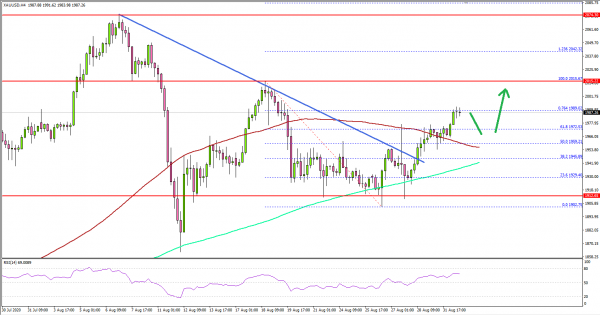

After forming a support base above $1,910 and $1,920, gold price started a fresh increase against the US Dollar. The price broke a couple of key hurdles near $1,950 to move back into a positive zone.

The 4-hours chart of XAU/USD indicates that the price climbed higher nicely from the $1,902 swing low. There was a break above a crucial bearish trend line at $1,945.

The bulls were able to push the price above the $1,950 resistance, the 100 simple moving average (red, 4-hours), and the 200 simple moving average (green, 4-hours). More importantly, the price climbed above the 50% Fib retracement level of the downward move from the $2,015 high to $1,902 low.

On the upside, the first major resistance is near the $2,000 level, followed by the $2,015 high. A successful close above the $2,015 level might open the doors for a larger increase towards $2,050 or even $2,050.

If there is no upside break above $2,000 or $2,015, the price might start a fresh decline. The first major support is near $1,960 or the 100 SMA, below which it could revisit $1,945.

Looking at EUR/USD and GBP/USD, both gained bullish momentum above 1.1950 and 1.3400 respectively to set a new multi-week high.

Economic Releases to Watch Today

- German Retail Sales for July 2020 (MoM) – Forecast 0.5%, versus -1.6% previous.

- German Retail Sales for July 2020 (YoY) – Forecast 3.0%, versus 5.9% previous.

- US ADP Employment Change for August 2020 – Forecast 950K, versus 167K previous.