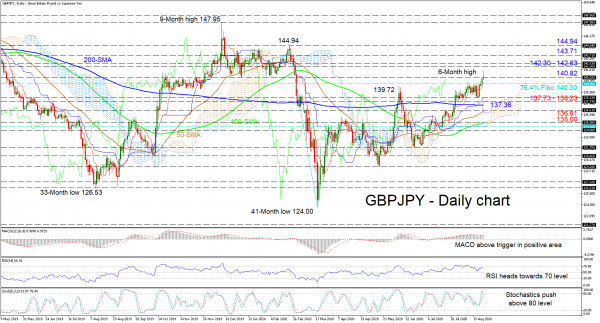

GBPJPY is gaining ground, currently striving to close above 140.82 to clearly resume the climb. The steady incline is also sponsored by the progressing Ichimoku lines and the advancing 50- and 100-day simple moving averages (SMAs). Additionally, an approaching bullish crossover of the 200-day SMA by the 50-day one may fortify the positive outlook.

The short-term oscillators further support an improving picture. The MACD, some distance in the positive area, is above its red signal line, while the RSI is pushing to climb above the 70 mark. The %K line of the stochastic oscillator is stalling in overbought territory but has yet to confirm any bearish tone, thus endorsing further advances.

If the price continues to develop, a band of inside swing lows from 142.30 to 142.63 may deliver initial resistance. If buyers manage to overcome this, the key 143.71 high could then draw traders’ focus. Sustained buying may then be challenged by the 144.94 peak, identified on February 21.

In the event sellers retake control, early support may come at the 140.00 handle, which happens to be the 76.4% Fibonacci retracement of the down leg from 144.94 – 124.00, and where the red Tenkan-sen line is located. Fading further the 137.73 – 138.23 region of lows – where the blue Kijun-sen lies – could attempt to dismiss the retreat. Not far underneath, another tough support zone (137.36 to 136.61), where the nearing bullish crossover of the 200-day SMA is forming, could challenge the descent.

In brief, the short-to-medium term bias is bullish above the 137.73 to 138.23 support section. If the pair plummets below the 100-day SMA at the 135.00 trough, this could spark bearish concerns.