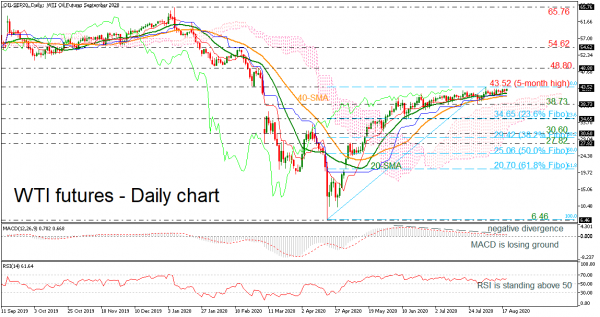

WTI crude oil is moving sideways in the short-term, in a slightly bullish structure beneath the five-month high of 43.52. The 20- and 40-day simple moving averages (SMAs) are acting as strong support for the bears; however, the MACD oscillator is indicating a negative divergence in the market, signaling a possible bearish retracement.

A successful climb above the five-month high of 43.52 could challenge the 48.80 resistance, registered on March 3. Even higher, the 54.62 barrier taken from the peak on February 20 could be a strong resistance for traders.

On the other side, a decline below the SMAs could hit the 38.73 support, before meeting the 23.6% Fibonacci retracement level of the up leg from 6.46 to 43.52 at 34.65. More downside pressure could add bearish sentiment, pushing the commodity towards the 30.60 barrier, ahead of the 38.2% Fibonacci of 29.42.

Summarizing, oil prices have been in a neutral mode over the last two months, failing to post a noteworthy upside movement.