EUR/USD is trading in the green, but is showing some exhaustion signs on the Daily chart. Is bullish because is located above some important support levels. Has changed little in the morning and most likely is waiting for the Euro-zone data to bring some action. The Germn Factory Orders rose by 1.0% in June, exceeding the 0.6% estimate.

The Italian Retail Sales may increase by 0.1% in June and could come in the positive territory after two decreasing months, the Euro-zone Retail Sales will be released as well.

You should be careful in the afternoon as the US is to release high impact data. The fundamental factors will take the lead again, a high volatility is expected in the US session.

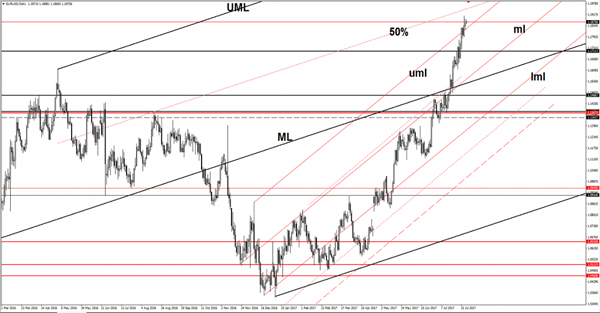

EUR/USD is trading above the upper median line (uml) of the minor ascending pitchfork and is fighting hard to approach and reach the 1.1909 previous high. We have an important upside target at the 50% Fibonacci line (ascending dotted line) as well, will reach this obstacle only if will have enough energy to close above the previous high.

A failure to make new high will signal an overbought and a potential drop below the upper median line (uml). The bias is bullish as long as the rate is trading above the upper median line (uml). The greenback could take the lead on the short term if the US data will impress in the afternoon.