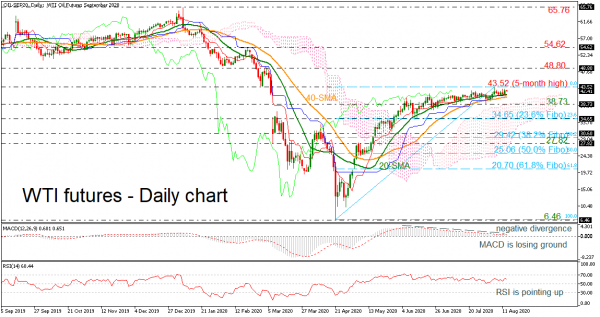

WTI crude oil futures are moving higher with weak momentum and reached a fresh five-month high of 43.52 in the preceding days. The MACD oscillator is showing a negative divergence, suggesting slowing upside movement that is indicating a bearish reversal on price. However, the RSI is still pointing upwards in the positive territory.

A clear upside rally above the 43.52 resistance could open the way for a revisit of the 48.80 barrier, registered on March 3. Breaching this level, the market could make a pause around the 54.62 hurdle, taken from the peak on February 20.

On the flip side, a decline beneath the 20- and 40-day simple moving averages (SMAs) could take the commodity towards the 38.73 support, which overlaps with the upper surface of the Ichimoku cloud. Beneath this level, the price could meet the 23.6% Fibonacci retracement level of the up leg from 6.46 to 43.52 at 34.65 ahead of the 29.42 – 30.60 support zone, which includes the 38.2% Fibonacci.

In brief, WTI crude oil has been in a smooth bullish move in the short-term and steeper increases could confirm a strong positive outlook in the medium term.