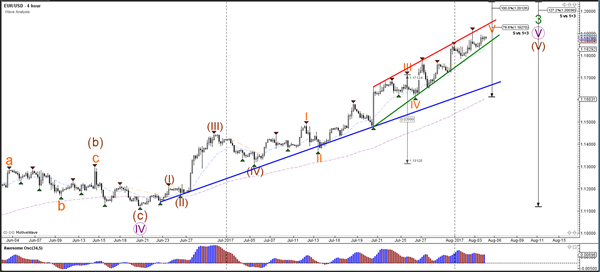

Currency pair EUR/USD

The Non Farm Payroll (NFP) numbers will be released later today for the US, which could significantly impact the US Dollar. The EUR/USD specifically is in an uptrend but could be losing some of its momentum because the angle of resistance trend line (red) is shallower than the support trend line (green). This indicates a mild rising wedge chart pattern, which is a potential reversal pattern. However, this does not stop price from continuing with the trend potentially towards the next target at the round level of 1.20 and Fibonacci targets.

The EUR/USD completed a wave 4 (grey) correction if price manages to break above the resistance trend line (orange). The bullish breakout could see price continue with one more higher high towards the wave 5 (grey) Fib levels.

Currency pair USD/JPY

The USD/JPY could show a potential bullish bounce at support to complete a wave B (orange) and start a wave C (orange).

The USD/JPY could have completed 5 waves (grey) within wave C (purple). A bullish breakout above resistance (orange) could see price challenge the Fibonacci targets of wave C vs A (orange).

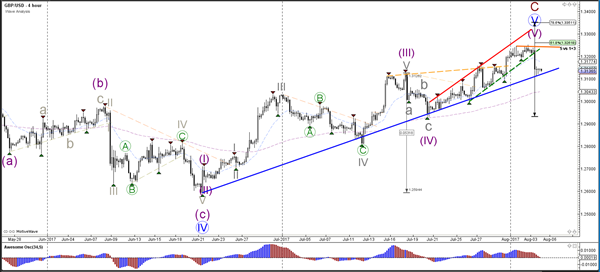

Currency pair GBP/USD

The GBP/USD failed to break above the 1.3250 quarter level and made a bearish reversal during yesterday’s interest rate decision by the Bank of England to keep rates at 0.25%. The bearish price action broke below the channel support (dotted green) but stopped at the larger support level. The lack of a bullish break is making a larger wave C (brown) now more likely.

The GBP/USD could potentially be in a bearish correction such as a wave 4 (grey) as long as price stays above the top of wave 1 (grey) indicated by the light blue line. Another valid wave structure could be a wave 1-2 (red) downtrend as the bearish momentum was strong. This would become more likely if price manages to break below the support trend lines (blue) or move correctively upwards as part of wave 2 (red).