Key Highlights

- EUR/USD struggled to clear 1.1920 and corrected lower.

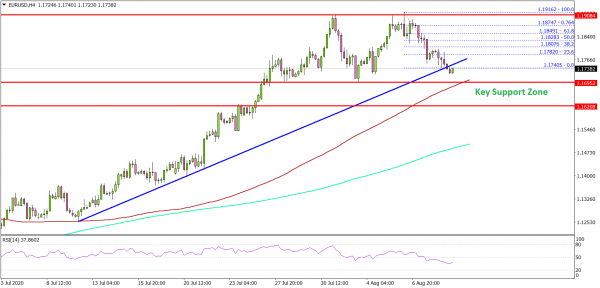

- A key bullish trend line was breached with support near 1.1750 on the 4-hours chart.

- A crucial support seems to be forming near the 1.1700 level.

- The German ZEW Economic Sentiment Index could decline from 59.3 to 58.0 in August 2020.

EUR/USD Technical Analysis

This past week, the Euro remained in a positive zone above 1.1800 against the US Dollar. However, EUR/USD struggled to gain traction above 1.1900 and recently corrected lower.

Looking at the 4-hours chart, the pair topped near 1.1916 and declined below the 1.1850 support zone. The pair even broke the 1.1800 support, but it remained well above the 100 simple moving average (red, 4-hours).

A swing low is formed near 1.1740 and the pair is trading above a couple of important supports. It seems like there is a crucial support seems to be forming near the 1.1700 level.

If there is a downside break below the 1.1700 support zone and the 100 SMA, there is a risk of a bearish break in the coming sessions. The next major support is near the 1.1620 level.

Conversely, the pair might start a fresh increase above the 1.1820 level. The first major resistance is near the 1.1850 level, above which EUR/USD might make another attempt to rise above the 1.1900 barrier in the near term.

Overall, EUR/USD must stay above 1.1700 to start a fresh increase. Besides, gold price remained stable above $2,000 and it seems like the price is likely to climb higher towards $2,070 and $2,080.

Upcoming Economic Releases

- UK Claimant Count Change July 2020 – Forecast 10.0K, versus -28.1K previous.

- UK ILO Unemployment Rate June 2020 (3M) – Forecast 4.2%, versus 3.9% previous.

- German ZEW Economic Sentiment Index August 2020 – Forecast 58.0, versus 59.3 previous.