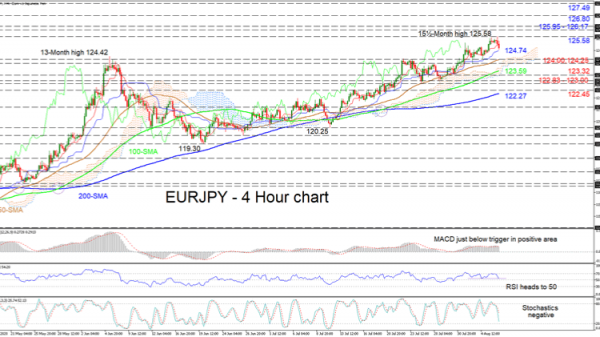

EURJPY continues to dictate an improving picture as price triumphs above the Ichimoku cloud and the simple moving averages (SMAs). The advancing Ichimoku lines and positively charged SMAs endorse the prevailing uptrend regardless of the latest weakening in the pair.

The short-term oscillators mirror the recent deterioration in positive momentum. The MACD, in the positive region, has dipped below its red trigger line, while the RSI deflected off the 70 level and nears the neutral threshold. Moreover, the stochastics hold a negative bearing.

If the pair suffers further weakening, initial hindrance may come from the blue Kijun-sen line at 124.74 ahead of the cloud’s upper band, which is fortified by the 124.00 and 124.25 troughs. If selling intensifies, the 100-period SMA at 123.59 may test the decline ahead of the 123.32 barrier. Should the 122.83 to 123.00 support region fail to terminate steeper declines, the pair may extend towards the 122.45 low prior to the 200-period SMA currently at 122.27.

If buyers retake control and steer above the immediate red Tenkan-sen line, initial obstructions may occur at the 15½-month high of 125.58 ahead of the 125.95 to 126.17 resistance zone. Overcoming this too, the price may run up to the 126.80 border before targeting the 127.49 resistance.

Summarizing, for the very short-term positive picture to be preserved, the price would need to hold above the SMAs and the 124.00 – 124.25 section. A break above 125.58 may boost the positive picture while a shift initially below the 200-period SMA may trigger worries of negative tendencies.