EUR/USD

Current level – 1.1762

The support at 1.1700 held the market according to expectations, however sellers entering the market at 1.1900 suppose that a pause in the current trend is underway. A few scenarios from here are possible. One of them is if prices hold above the support 1.1700 and buyers again charge towards 1.1900, from there bears might give a last try to take prices down. If they fail to form a lower low from there, a small range below 1.1900 could occur signaling an imminent breach that could take prices as high as the next resistance zone at 1.2150-1.2220. Due to the speed and aggression while the high at 1.1900 was formed, prices might not be able to hold above 1.1700. The next support is at 1.1580 and, if tested, it should be with a violent and fast move in both directions returning trade above 1.1700. This way that storyline can continue to develop as the first one. In a case in which prices stay below 1.1700, a deeper and longer pullback can be expected because it would belong to the higher time frames and for them the first support is at 1.1460. Today, the notable events in the calendar are the production price index for the Eurozone (09:00 GMT) and factory orders for the US (14:00 GMT)

| Resistance | Support | ||

| intraday | intraweek | intraday | intraweek |

| 1.1770 | 1.2080 | 1.1700 | 1.1600 |

| 1.1900 | 1.2200 | 1.1600 | 1.1520 |

USD/JPY

Current level – 106.11

Despite the quick and strong pullback of the pair, sentiment remains sour and the upside limited. Bears are in control of prices as long as they are below the zone 106.70-107.18. Daily support for the bulls can be found at 105.56 and the resistance around 106.15-106.20. A push towards the next one at 106.70 is also possible. For the export oriented Japan, a strong yen is not favorable and its central bank and government showed readiness to intervene on the markets if rates head again towards 104.20. The pair, however, remains in the grip of COVID-19 and geopolitics. And if investors expect turbulence in equities, they would enter that market and a drop to 104.20 remains the more plausible scenario.

| Resistance | Support | ||

| intraday | intraweek | intraday | intraweek |

| 106.15 | 106.72 | 105.56 | 104.20 |

| 106.72 | 107.18 | 104.88 | 103.10 |

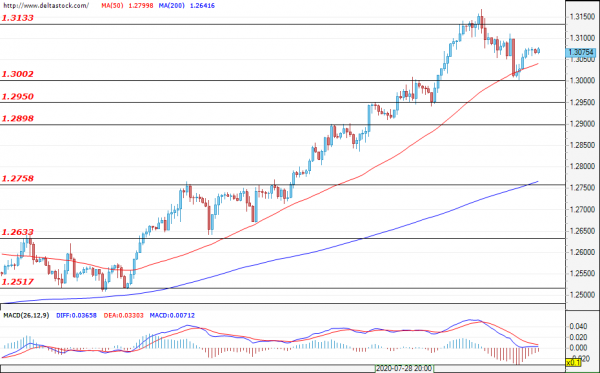

GBP/USD

Current level – 1.3075

The sterling is performing nicely against the US dollar as well, however the rally could be on pause due to sellers entering the market around 1.3150. First support here is 1.3000, but a deeper pullback to 1.2950-1.2900 and even 1.2760 is possible. The resistance zone is at 1.3100-1.3150. The market could struggle to find direction and remain choppy until Thursday as investors expect Bank of England interest rate decision, forward guidance on monetary policy and additional information on Brexit. The event is to take place at 06:00 GMT. If the initial trend is renewed, potential targets for buyers could be the zones around 1.3200 and 1.3350.

| Resistance | Support | ||

| intraday | intraweek | intraday | intraweek |

| 1.3100 | 1.3200 | 1.2950 | 1.2760 |

| 1.3200 | 1.3300 | 1.2898 | 1.2630 |