The pair extends the latest gains and looks motivated to approach new peaks in the upcoming days. It is strongly bullish and is very close to stabilize above the 131.00 psychological level. EUR/JPY further increase was confirmed in the morning when has managed to jump above the 130.76 previous high. I’ve said in the previous analysis that we’ll have a great buying opportunity if the rate will make this move.

The Yen drops again as the Nikkei stock index has opened with a gap up today. JP225 is pressuring the 20058 major static resistance again, so we have to be patient to see what will happen because is narrowing on the short term.

Technically, the Nikkei was somehow expected to drop towards the 19700 static support, but looks like that the buyers are still in the game. Another Nikkei’s rejection will send the Yen higher again versus all its rivals, but a valid breakout followed by an increase towards the 20320 previous high will ruin the

Japanese currency. The Yen ignored the Japanese Consumer Confidence, which has increased from 43.3 to 43.8 points, beating the 43.5 estimate.

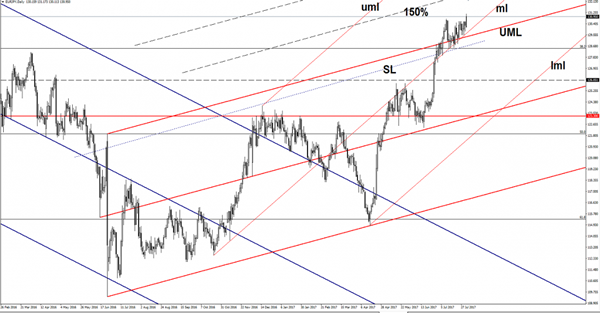

EUR/JPY managed to climb as much as 131.17 in the morning, the next important upside target is at the 150% Fibonacci line (ascending dotted line). Should climb towards new peaks after the failure to retest the median line (ml) of the minor ascending pitchfork. The upside momentum was expected after the retest of the upper median line (UML) of the major ascending pitchfork and the 32.8% retracement level.

The next major upside target is at the upper median line (uml) of the minor ascending pitchfork, will approach this obstacle only if the Nikkei will close above the 20320 previous high.