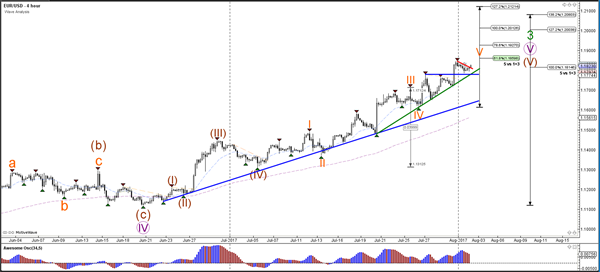

Currency pair EUR/USD

The EUR/USD built a small correction after the bullish breakout earlier this week. The bearish retracement stayed above support trend lines (green/blue) and could now be ready for a continuation towards the Fibonacci targets of wave 5 vs 1+3 at 1.1925 and even 1.20.

The EUR/USD seems to have completed a wave 4 (grey) retracement within wave 5 (orange). A bullish breakout above the resistance trend line (red) and the previous top at 1.1850 could indicate the end of wave 4 and the start of wave 5 (grey).

Currency pair USD/JPY

The USD/JPY bounced at the round level of 110, which acted as support and caused the reversal as mentioned yesterday. The bullish breakout above resistance (dotted orange) could signal the completion of wave A (brown) and start of wave B (brown).

The USD/JPY indeed completed a wave 4 (purple) within the 5th wave (orange) before building a potential bullish reversal as indicated in the potential 5 wave (purple).

Currency pair GBP/USD

The GBP/USD reached the 1.3250 quarter level and is now building a correction. A break above the trend line (orange) could indicate a continuation. Whether the wave 3 (blue) will indeed be confirmed depends on how far the GBP/USD will move. A failure to break above the 100% Fibonacci target could indicate an ABC rather than a 123.

The GBP/USD could be building an extension of the wave 3 (green) with 5 internal waves (orange/purple). A pullback could be part of the wave 4 (purple) which means that the Fibonacci levels of wave 4 vs 3 could act as support.