A note on lower timeframe confirming price action…

Waiting for lower timeframe confirmation is our main tool to confirm strength within higher timeframe zones, and has really been the key to our trading success. It takes a little time to understand the subtle nuances, however, as each trade is never the same, but once you master the rhythm so to speak, you will be saved from countless unnecessary losing trades. The following is a list of what we look for:

- A break/retest of supply or demand dependent on which way you’re trading.

- A trendline break/retest.

- Buying/selling tails … essentially we look for a cluster of very obvious spikes off of lower timeframe support and resistance levels within the higher timeframe zone.

- Candlestick patterns. We tend to only stick with pin bars and engulfing bars as these have proven to be the most effective.

We typically search for lower-timeframe confirmation between the M15 and H1 timeframes, since most of our higher-timeframe areas begin with the H4. Stops are usually placed 1-3 pips beyond confirming structures.

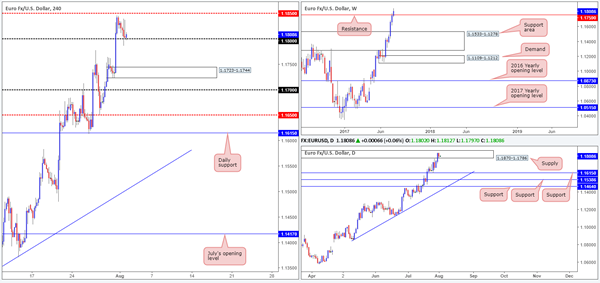

EUR/USD

After the single currency topped at 1.1845 on Monday, price clawed back some of Monday’s gains yesterday and ended the day retesting the 1.18 handle. As you can see, this psychological band remains unbroken in spite of there being little bullish intent registered from here.

Peering over to the daily picture shows us that price is currently trading within the walls of supply coming in at 1.1870-1.1786. Though this area is fresh and has a strong-looking base, we’re a little concerned with weekly price recently crossing above resistance at 1.1759, which could, if the bulls remain in a dominant position, further encourage buying up to a weekly resistance planted at 1.2044.

Our suggestions: As of now, we consider the 1.18 handle to be key. Should it continue to offer support, this could signify the end for our daily supply. On the flip side to that, a close below this number potentially opens up the door to the H4 demand base marked at 1.1723-1.1744 as well as confirms bearish strength from the daily supply.

As we’re still short the GBP/USD, we are naturally looking for a break lower!

Data points to consider: US ADP non-farm employment change at 1.15pm GMT+1.

Levels to watch/live orders:

- Buys: Flat (stop loss: N/A).

- Sells: Flat (stop loss: N/A).

GBP/USD

In a similar fashion to the EUR/USD, the GBP/USD also clawed back partial gains on Tuesday. The move saw the unit close back below the H4 channel resistance extended from the high 1.3053 (something we missed in our preliminary analysis) and conclude the day retesting the 1.32 handle.

For those who follow our reports on a regular basis, you may recall that our desk took a short position from 1.3209, with conservative stops planted at 1.3280. Our reasoning behind executing a short position here was primarily due to daily structure surrounding the supply at 1.3278-1.3179 (our stops are positioned two pips above this zone). We have a trendline resistance taken from the high 1.3477, a channel resistance drawn from the high 1.2903 and two converging AB=CD (green/orange arrows) 127.2 Fib extensions at 1.3222/1.3223 (taken from the lows 1.2811/1.2365). Also, for you RSI fans, there is daily divergence in play, as well. Encouragingly, daily price also printed a rather nice-looking selling wick yesterday, thus adding weight to the setup.

Our suggestions: Ultimately, we are looking for H4 price to cross below the 1.32 boundary today as this will not only confirm bearish strength from daily supply, but also open up the path south down to the mid-level base 1.3150.

Data points to consider: UK construction PMI at 9.30am. US ADP non-farm employment change at 1.15pm GMT+1

Levels to watch/live orders:

- Buys: Flat (stop loss: N/A).

- Sells: 1.3209 ([live] stop loss: 1.3280).

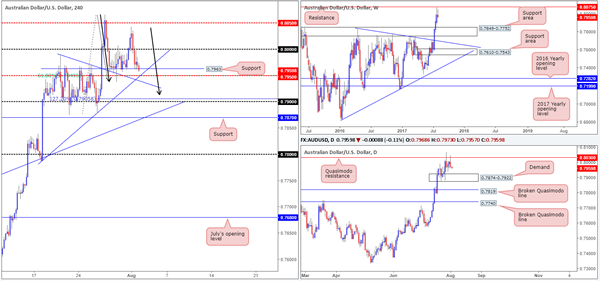

AUD/USD

The AUD/USD pair was under noticeable pressure on Tuesday, following the RBA monetary policy statement released in early trading.

As of current price, we can see that H4 flow is, once again, now challenging support at 0.7963, which happens to fuse closely with a H4 trendline support taken from the high 0.7987, a nearby H4 mid-level support at 0.7950 and also a H4 61.8% Fib support at 0.7950 drawn from the low 0.7877. Judging by the recent H4 candle action, however, the current support looks vulnerable, in our opinion. In addition to this, both the weekly and daily timeframes show room to extend lower, with the closest support seen at daily demand drawn from 0.7874-0.7922. Further adding to this, it’s clear to see that the H4 candles are in the process of chalking up a D-leg to an AB=CD bullish formation (black arrows) which completes just ahead of the 0.79 handle (the 127.2% ext. at 0.7905).

Our suggestions: In the long run, we do believe the Aussie is still heading lower. However, selling this market is awkward. Not only do we have to wait for H4 price to close below 0.7950 to be clear of immediate support, we’re then unfortunately left with little space for a reasonable sell given that the top edge of the daily demand area is located nearby at 0.7922!

Data points to consider: Australian Building approvals at 2.30am. US ADP non-farm employment change at 1.15pm GMT+1.

Levels to watch/live orders:

- Buys: Flat (stop loss: N/A).

- Sells: Flat (stop loss: N/A).

USD/JPY

Try as it might, the USD/JPY could not muster enough strength to breach the 110 handle on Tuesday. As a result of this, the pair is currently seen teasing the mid-level resistance pegged at 110.50.

From the weekly timeframe, the market looks as though it could continue to press lower until we reach the small demand base seen at 108.13-108.95. Zooming in and looking at the daily picture, we can see that price looks poised to retest 110.76 as resistance. Should this come to fruition, we could see the unit potentially reverse from here and challenge the Quasimodo support logged at 109.11, which happens to unite closely with a trendline support etched from the low 108.13.

Our suggestions: With the higher-timeframe picture suggesting that further selling could be on the cards, we have our eye on the 111 handle today. This number – coupled with a nice-looking H4 Fibonacci resistance cluster (50.0%/61.8%/78.6% taken from the highs 112.19/111.71/111.28) and June’s opening level at 110.83, makes for a strong-looking sell base (green zone).

However, since there’s a risk of price faking beyond our sell zone to test May’s opening level seen nearby at 111.31, we would strongly advise waiting for lower-timeframe confirming action (see the top of this report for details), before pulling the trigger.

Data points to consider: US ADP non-farm employment change at 1.15pm GMT+1.

Levels to watch/live orders:

- Buys: Flat (stop loss: N/A).

- Sells: 111.07/110.83 ([Waiting for a lower-timeframe confirming signal to form is advised before pushing the sell button here] stop loss: dependent on where one confirms the area).

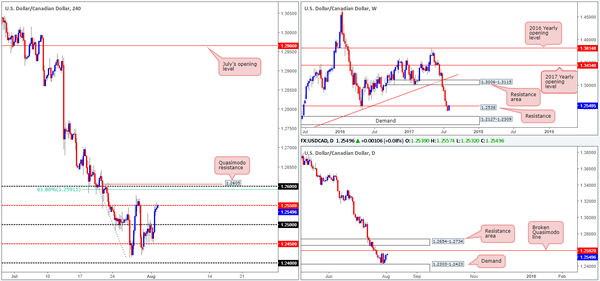

USD/CAD

Based on recent movement, the weekly chart shows price to be challenging resistance at 1.2538. With this level having been a strong support base in the past, it is highly likely we’ll see some selling pressure here. A closer look at price action reveals that daily price is currently hovering just ahead of a broken daily Quasimodo level positioned at 1.2592.

A quick recap of Tuesday’s action on the H4 chart reveals that the unit is currently kissing the underside of a mid-level resistance at 1.2550, after aggressively rallying from the mid-level support at 1.2450. The next upside target beyond 1.2550 is the 1.26 handle, which happens to unite closely with a 61.8% Fib resistance at 1.2591 extended from the high 1.2701 and a mini Quasimodo resistance pegged at 1.2605.

Our suggestions: With all three timeframes suggesting a sell, along with the trend on this pair pointing to the downside, we will be looking to short from the 1.26 vicinity today. With that being said, however, due to psychological levels being prone to fakeouts, we will only sell this market if the pair chalks up a reasonably sized H4 bearish candle, preferably in the shape of a full, or near-full-bodied candle.

Data points to consider: US ADP non-farm employment change at 1.15pm. Crude oil inventories at 3.30pm GMT+1.

Levels to watch/live orders:

- Buys: Flat (Stop loss: N/A).

- Sells: 1.26 region ([waiting for a full or near-full-bodied bearish candle to emerge is advised] stop loss: ideally beyond the candle’s wick).

USD/CHF

Despite the USD/CHF trading from a weekly trendline resistance extended from the low 0.9257, and daily price trading from a highly confluent supply base at 0.9738-0.9691 (converges with a channel resistance extended from the high 0.9808 and a 38.2% Fib resistance at 0.9693 taken from the high 1.0099) at the moment, the bears are seen struggling to overcome H4 demand at 0.9627-0.9648. The next H4 resistance in view is June’s opening level at 0.9680, followed closely by the 0.97 handle. Should these levels fail to provide resistance, then the last remaining resistance on the radar is a H4 trendline resistance taken from the low 0.9775.

Our suggestions: For those wishing to sell, we would advise watching how the H4 candles respond once the pair is in contact with 0.97/0.9680. Should you happen to pin down a nice-looking H4 bearish candle, preferably in the shape of a full, or near-full-bodied candle, then a sell from this neighborhood could be an option today.

Data points to consider: US ADP non-farm employment change at 1.15pm GMT+1.

Levels to watch/live orders:

- Buys: Flat (stop loss: N/A).

- Sells: 0.97/0.9680 region ([waiting for a full or near-full-bodied bearish candle to emerge is advised] stop loss: ideally beyond the candle wick).

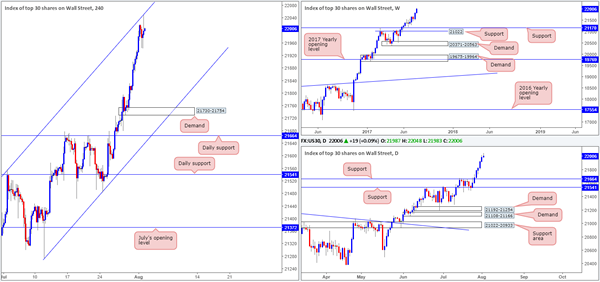

DOW 30

In recent trading, the H4 candles shook hands with a channel resistance extended from the high 21493. As a result of this, a relatively nice-looking bearish selling wick took shape. Could this be enough to trigger a move down to the neighboring channel support taken from the low 21273?

While, of course, this is a possibility, one has to remain cognizant of the surrounding landscape. Both weekly and daily action shows absolutely no resistance on the horizon given that the index is trading at record highs at the moment. The flip side to this, however, is the closest support on the bigger picture does not come into play until daily support at 21664.

Our suggestions: Although there is a chance that this market may head south to test the H4 channel support given the lack of nearby higher-timeframe support, we would not feel comfortable selling the recent move north that is shaped by six strong consecutive daily bull candles.

Data points to consider: US ADP non-farm employment change at 1.15pm GMT+1.

Levels to watch/live orders:

- Buys: Flat (stop loss: N/A).

- Sells: Flat (stop loss: N/A).

GOLD

Gold prices pulled back yesterday as the dollar index marginally recovered from a low of 92.78. As you can see, H4 price failed to sustain gains beyond resistance at 1269.8, which saw the metal come within a few inches of H4 supply at 1281.1-1275.4.

From both the H4 and daily timeframes, we see little reason why the metal will not continue to punch lower and connect with daily support registered at 1258.9, which happens to converge with a H4 trendline support etched from the low 1235.1.

Our suggestions: A long from 1258.9 is promising, not only because it’s a noted daily support level and fuses with a H4 trendline support, but also since there is room seen on the both the weekly and daily charts for the unit to extend north, as far as the 1280.0ish region.

Levels to watch/live orders:

- Buys: 1258.9 region (waiting for a full or near-full-bodied bullish candle to emerge is advised] stop loss: ideally beyond the candle tail).

- Sells: Flat (stop loss: N/A).