Price dropped aggressively on Tuesday, erasing the Monday’s gains, we may have a selling opportunity if will come back to retest the resistance levels. Technically should drop on the short term after a false breakout above a major confluence area. The USD has managed to drag the price down only because the dollar index has managed to increase a little and to jump above the 93.00 psychological level again.

Unfortunately, the USDX is still pressured on the Daily chart, could still approach and reach the 92.49 static support despite the yesterday’s rebound.

You should know that the price will be driven by the fundamental factors later as the New Zealand is to release high impact data, the Employment Change could increase by 0.7% in Q2, while the Unemployment Rate could drop to 4.8%, from 4.9% in the second quarter. The Labor Cost Index may increase by 0.5%, more compared to the 0.4% growth in the former reading period. The US is to release the ADP Non-Farm Employment Change today, this event could bring a high volatility.

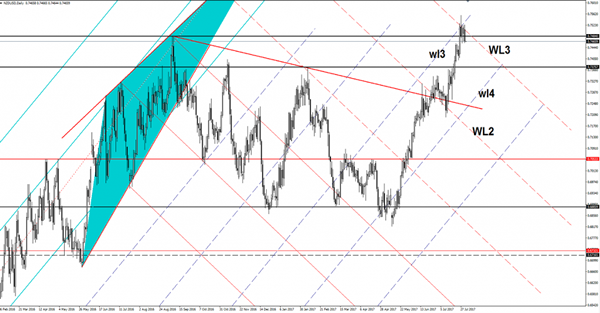

Price plunged in the last session and invalidated the breakout above the third warning line (WL3) of the major descending pitchfork. Now is trading under the 0.7484 static resistance, a retest of this level and the WL3 will bring us a perfect selling opportunity with first target at the 0.7375, the next one will be at the fourth warning line (wl4) of the former ascending pitchfork. I’ve said in the previous analysis that the perspective remains bullish as long as is trading above the wl4, a major drop will come only if it will take out the mentioned support. However a further increase will be confirmed only after a valid breakout above the WL3.