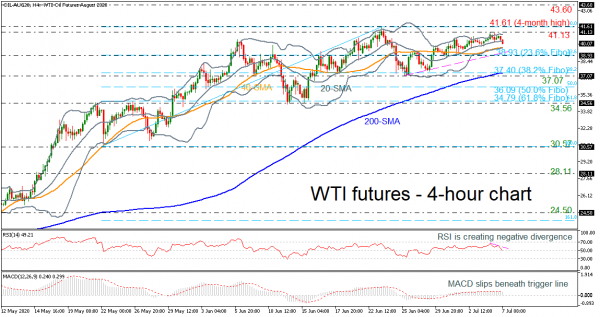

WTI crude oil futures are in a positive movement since June 25, however, the RSI indicator points lower. Currently, the market is heading beneath the mid-level of the Bollinger band and the MACD oscillator slipped under its trigger line in the 4-hour chart.

A continuation of the negative move could see immediate support come from the lower Bollinger band which overlaps with the 40-period simple moving average (SMA) at 39.72, before flirting with the 23.6% Fibonacci retracement level of the upward move from 30.57 to 41.61 at 38.93. In the event selling interest persists, the key support region of 37.07 – 37.40, which encapsulates the 38.2% Fibonacci and the 200-period SMA could halt the decline. Should it fail to do so, the 50.0% Fibonacci of 36.09 could challenge the bears before the price sinks towards the 61.8% Fibonacci of 34.79.

If buyers manage to jump above the upper Bollinger band and the 41.13 nearby high, a revisit of the four-month peak of 41.61 could unfold. Overcoming these constrictions could see resistance develop at the inside swing low of 43.60, registered on March 2.

Summarizing, the very short-term outlook remains bullish, however, the technical indicators are suggesting a downside pullback. A climb above 41.61 is required to set a clear bullish picture.