Key Highlights

- EUR/USD is finding a strong buying interest near the 1.1200 area.

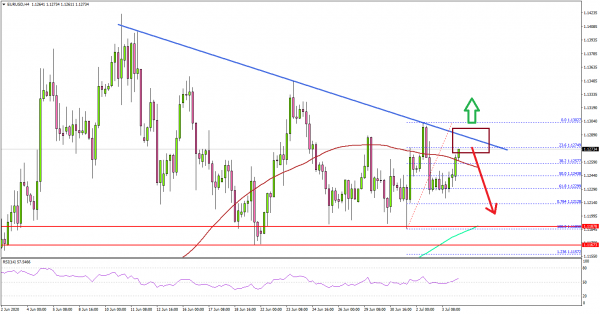

- A crucial bearish trend line is in place with resistance near 1.1280 on the 4-hours chart.

- The Euro Zone Retail Sales is likely to decline 15% in May 2020 (MoM).

- The US ISM Non-Manufacturing Index could increase from 45.4 to 49.5 in June 2020.

EUR/USD Technical Analysis

This past week, the Euro revisited the 1.1200 support level against the US Dollar. EUR/USD remained well bid near 1.1200, formed a low at 1.1185, and now seems to be eyeing the next crucial break.

Looking at the 4-hours chart, the pair recently tested the 1.1300 resistance. It failed to continue higher and corrected below the 50% Fib retracement level of the upward move from the 1.1185 swing low to 1.1302 high.

The pair is still trading nicely above the 1.1200 support, but it seems to be facing a strong resistance near 1.1280 and 1.1300. There is also a crucial bearish trend line in place with resistance near 1.1280 on the same chart.

To start a strong increase, the pair must climb above the trend line resistance, the 100 simple moving average (red, 4-hours), and the 1.1300 resistance.

If it fails to continue higher above 1.1280 or 1.1300, there is a risk of a sharp decline. The main support on the downside is near 1.1200, 1.1185, and the 200 simple moving average (green, 4-hours).

A successful daily close below the 1.1200 and 1.1185 support levels may perhaps open the doors for a larger decline. In the mentioned bearish case, the pair is likely to decline towards the 1.1120 and 1.1100 levels.

Overall, EUR/USD is facing an uphill task near 1.1280 and 1.1300. Similarly, GBP/USD must settle above 1.2500 and 1.2550 to start a sustained upward move.

Upcoming Economic Releases

- Euro Zone Retail Sales for May 2020 (YoY) – Forecast -7.5%, versus -19.6% previous.

- Euro Zone Retail Sales for May 2020 (MoM) – Forecast -15.0%, versus -11.7% previous.

- US Services PMI for June 2020 – Forecast 46.7, versus 46.7 previous.

- US ISM Non-Manufacturing Index for June 2020 – Forecast 49.5, versus 45.4 previous.