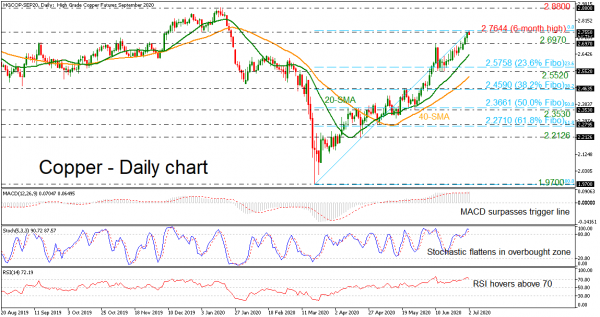

Copper is trading around the vicinity of the six-month top of 2.7644, achieved earlier today, continuing the buying interest that started on March 19.

Looking at the short-term oscillators, the stochastic and the RSI signal a slight decrease around their overbought marks as they are losing momentum. However, the MACD oscillator is still showing some improvements above its trigger line.

Should buyers drive above the six-month peak of 2.7644, they could encounter initial strengthened resistance from the 2.8800 barrier, taken from the high on January 16. A step above may meet further constrictions from the 2.9920 resistance, registered on April 2019.

Otherwise, if sellers take control, initial support could come from the 2.6970 level and the 20-day SMA at 2.6394 underneath. Diving further, immediate limitations may arise from the 23.6% Fibonacci retracement level of the up leg from 1.9700 to 2.7644 at 2.5758 slightly above the 2.5520 support. If the bears persist, the attention could then move towards the 38.2% Fibonacci of 2.4590.

All in all, the short-term timeframe sustains a bullish view. However, a break below the 61.8% Fibonacci of 2.2710 could reveal the next direction.