Price increased on Monday and resumed the Friday’s bullish candle, it is expected to climb much higher because is trading in the buyer’s territory. AUD/USD moves higher as the USDX dropped sharply again after the United States data was sent to the public. The US figures have come in mixed, but weren’t able to inspire the greenback.

USDX is trading much below the 93.00 psychological level and is expected to reach the 92.49 long term static obstacle, where he could find support again.

Price could be driven by the fundamental factors today because the economic calendar is filled with high impact data, the Reserve Bank of Australia will publish the Cash Rate, which is expected to remain steady at 1.50%. The Cash Rate remains unchanged since August 2016, maybe the RBA Rate Statement will bring a high volatility, so you should be careful. The AIG Manufacturing Index will be released as well later.

The perspective is bullish on the daily chart, the greenback could increase a little only if the United States data will come in better in the afternoon. Another disappointment will ruin the USD, which will resume the bearish momentum.

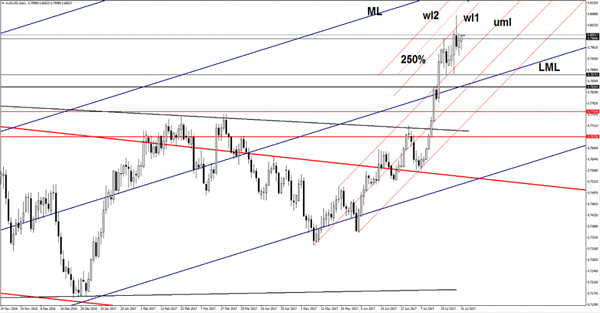

Price has managed to come back above the 0.7989 static resistance, a minor consolidation will bring a good buying opportunity with a first upside target at 0.8065 previous high. AUD/USD should increase further as long as the upper median line (uml) remains intact.