Key Highlights

- USD/CAD started a fresh increase above the 1.3550 resistance zone.

- It surpassed a major bearish trend line near 1.3580 on the 4-hours chart.

- The US Manufacturing PMI is likely to remain flat at 49.6 in June 2020.

- The US ISM Manufacturing PMI could increase from 43.1 to 49.4 in June 2020.

USD/CAD Technical Analysis

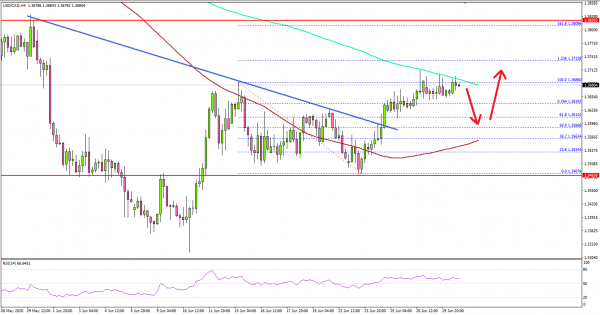

In the past few days, the US Dollar gained momentum from the 1.3480 support against the Canadian Dollar. USD/CAD surpassed the 1.3550 and 1.3580 resistance levels to move into a positive zone.

Looking at the 4-hours chart, the pair even climbed above the 1.3620 resistance and settled well above the 100 simple moving average (red, 4-hours).

It opened the doors for more upsides and the pair retested the 1.3700 resistance level and the 200 simple moving average (green, 4-hours). If the pair continues to rise, it could easily test the 1.236 Fib extension level of the downward move from the 1.3686 high to 1.3487 low.

Any further gains could lead USD/CAD towards the 1.3800 resistance area, which is close to the 1.618 Fib extension level of the downward move from the 1.3686 high to 1.3487 low.

If there is no upside break, the pair could start a downside correction. An initial support is near the 1.3620 level, below which the pair might revisit the 1.3550 support.

Overall, USD/CAD is likely to continue higher as long as it is above 1.3620. Looking at EUR/USD, the pair is still above 1.1150, but GBP/USD extended its decline below 1.2300.

Upcoming Economic Releases

- Germany’s Manufacturing PMI for June 2020 – Forecast 44.6, versus 44.6 previous.

- Euro Zone Manufacturing PMI June 2020 – Forecast 46.9, versus 46.9 previous.

- UK Manufacturing PMI for June 2020 – Forecast 50.1, versus 50.1 previous.

- US Manufacturing PMI for June 2020 – Forecast 49.6, versus 49.6 previous.

- US ADP Employment Change June 2020 – Forecast 3000K, versus -2760K previous.

- US ISM Manufacturing PMI for June 2020 – Forecast 49.4, versus 43.1 previous.