Key Highlights

- USD/JPY traded to a new monthly low at 106.07 before starting an upside correction.

- There was a break above a major declining channel with resistance near 107.00 on the 4-hours chart.

- The US Gross Domestic Product contracted 5% in Q1 2020, in line with the market forecast.

- The US Personal Income is likely to decline 6% in May 2020 (MoM).

USD/JPY Technical Analysis

Earlier this month, the US Dollar formed a crucial top near 109.84 and declined sharply against the Japanese Yen. USD/JPY broke a few key supports near 108.00 to enter a short-term bearish zone.

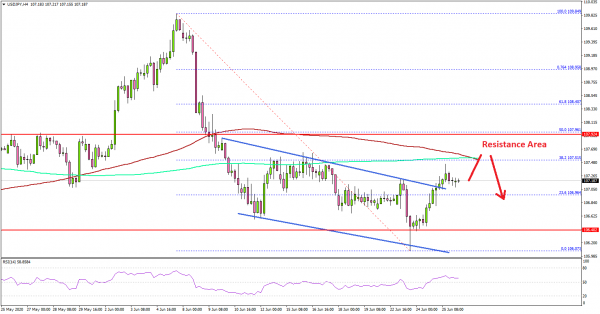

Looking at the 4-hours chart, the pair traded as low as 106.07, and settled below the 100 simple moving average (red, 4-hours) and the 200 simple moving average (green, 4-hours).

Recently, the pair started a decent recovery wave above the 106.50 and 107.00 resistance levels. There was a break above the 23.6% Fib retracement level of the recent decline from the 109.84 high to 106.07 low.

Moreover, there was a break above a major declining channel with resistance near 107.00. It opened the doors for more gains, but the pair is facing a couple of significant hurdles near 107.80 and 108.00 levels.

The 50% Fib retracement level of the recent decline from the 109.84 high to 106.07 low is also near 107.96. Therefore, the pair must settle above 108.00 and the 100 SMA to start a strong upward move.

If not USD/JPY might start a fresh decline and trade below the 106.80 support. The next major support is near the 106.00 level, below which the bears might aim 105.40.

Fundamentally, the Gross Domestic Product annualized report for Q1 2020 was released by the US Bureau of Economic Analysis. The market was looking for a 5% decline in the GDP in Q1 2020.

The actual result was in line with the forecast, as the US GDP contracted 5% (according to the “third” estimate).

The report added:

Real gross domestic income (GDI) decreased 4.4 percent in the first quarter, in contrast to an increase of 3.1 percent in the fourth quarter.

Overall, USD/JPY is facing an uphill task near the 108.00 resistance zone. Looking at EUR/USD and GBP/USD, both pairs are showing bearish signs below 1.1250 and 1.2500 respectively.

Upcoming Economic Releases

- US Personal Income for May 2020 (MoM) – Forecast -6.0%, versus +10.5% previous.

- US Personal Spending for May 2020 (MoM) – Forecast +9%, versus -13.6% previous.