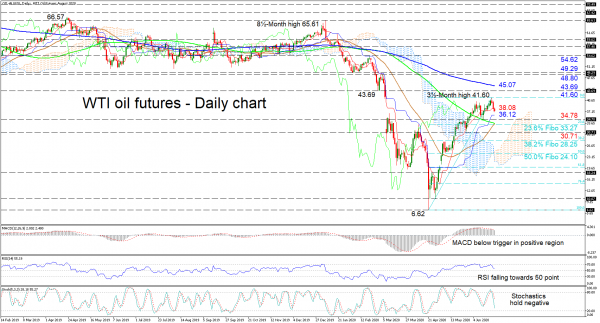

WTI oil futures faded prior to reaching a critical resistance level at 43.69 and appear to be reloading for a push higher to revisit this mark. The recent weakening in the price is mirrored in the flattening of the Ichimoku lines and within the short-term oscillators. However, the near completion of a bullish crossover of the 100-day simple moving average (SMA) by the soaring 50-day one could boost positive sentiment and refuel the unbroken positive tone in the Ichimoku lines.

The MACD, located deep in the positive zone, is gliding below its red signal line, while the RSI is decreasing in bullish territory towards the 50 threshold. Furthermore, the stochastic lines are strongly negative with room to move towards the oversold region, thus suggesting further loss of ground for now.

If sellers maintain control, the blue Kijun-sen line at 36.12 and the nearby low of 34.78 could deter initial negative moves. A step below may encounter a much more durable support border at 33.27, where a bullish crossover between the 100- and 50-day SMAs is currently taking form. Should this level – which happens to be the 23.6% Fibonacci retracement of the up leg from 6.62 to 41.60 – fail to halt the descent, the bears may be challenged by the important trough of 30.71. If steeper declines unfold, the price may meet the 38.2% Fibo of 28.25 and the 50.0% Fibo of 24.10.

Alternatively, driving the price north, early resistance could surface at the 41.60 high ahead of the vital inside swing low at 43.69. Conquering this essential obstacle, the price may be tested by the 200-day SMA at 45.07 before shooting to the resistance band from 48.80 to 49.29. Another climb could then target the 54.62 peak of February 20.

Summarizing, the pair remains bullish above 34.78 in the very near-term and a break above 43.69 could reinforce this outlook.