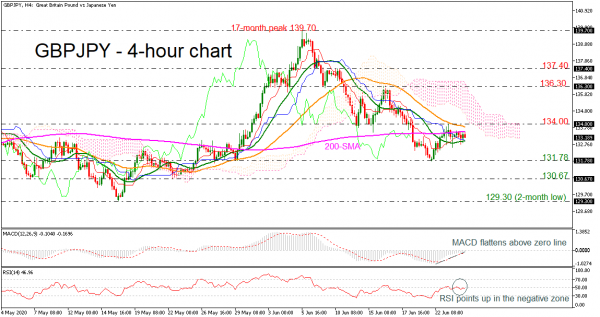

GBPJPY has found strong resistance near the 200-period simple moving average (SMA) currently at 133.55, confirming the neutral move in the very short-term timeframe.

The MACD oscillator is rising above the trigger line near the zero level, while the RSI is pointing south near the 50 level. However, the red Tenkan-sen line jumped above the blue Kijun-sen line, indicating a climb above the 200-day SMA.

If there is a drop below the 20-period SMA, the price could find a support at the 131.78 barrier, before challenging the 130.67 hurdle, taken from the low from May 28. More losses could drive the bears towards the two-month bottom of 129.30.

On the other hand, an upside recovery could meet the 40-period SMA, which stands marginally below the 134.00 handle. Moving higher, the 136.30 resistance and the upper surface of the Ichimoku cloud around 136.62 could attract attention, as the price paused several times in this zone in the past, while a rally above that region could last until 137.40.

In the short-term, the downside structure started after GBPJPY topped at 139.70 on June 5 and a break below the 131.78 trough could create a new lower low.