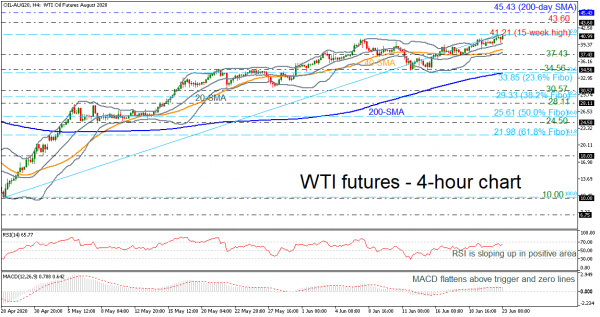

WTI crude oil futures came close to breaking the 15-week high of 41.21 and the upper Bollinger band in the 4-hour chart. According to the RSI, the market could maintain positive momentum as the indicator is positively sloped above its neutral threshold of 50, though the MACD oscillator is still continuing with somewhat weak momentum above the zero lines.

On the upside, the price could attempt to overcome the 41.21 high and retest the 43.60 resistance, which if successfully broken the door could open for the 200-simple moving average (SMA) in the daily timeframe at 45.43.

A reversal to the downside, however, could find immediate support at the 20- and 40-period SMAs currently at 39.64 and 38.49 respectively, while slightly lower, the lower Bollinger band at 37.97 and the 37.43 support could also come into view. If the latter fails to halt bearish movements, the next target could be the area between 34.56 and the 23.6% Fibonacci retracement level of the upward move from 10.00 to 41.21 at 33.85, which coincides with the 200-period SMA.

Turning to the medium-term trading, the outlook has been positive over the past three months. On the other hand, a significant decline below the 200-period SMA could shift the outlook to neutral.