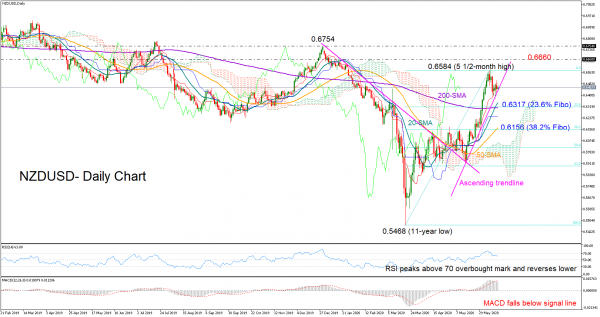

NZDUSD is smoothly curving up along a short ascending trendline following the slight pullback from the 5 ½-month high of 0.6854 last week.

According to the RSI and the MACD, the pair continues to seek new lows as the former has already topped above its 70 overbought mark and reversed lower, while the latter continues to decelerate below its red signal line.

Technically, however, only a break below the trendline could bring more sellers on board and push support towards the 20-day simple moving average (SMA) and the 0.6317 level, where the 23.6% Fibonacci retracement level of the 0.5468-0.6854 bullish run and the 200-day SMA are currently coinciding. The 38.2% Fibonacci of 0.6156 and the 50-day SMA could be the next targets if negative pressure persists.

Alternatively, if the trendline proves a tough obstacle, the focus will shift back to the 0.6854 peak, where any close higher would open the door for the 0.6660 resistance region and then for the 0.6754 peak.

Turning to the medium-term picture, the outlook has switched to neutral following the rally above 0.6340 and it remains to be seen if this could improve to a positive one above 0.6854.

In brief, NZDUSD is currently in neutral mode, expecting its next downfall to take place below the trendline and towards the 20-day SMA.