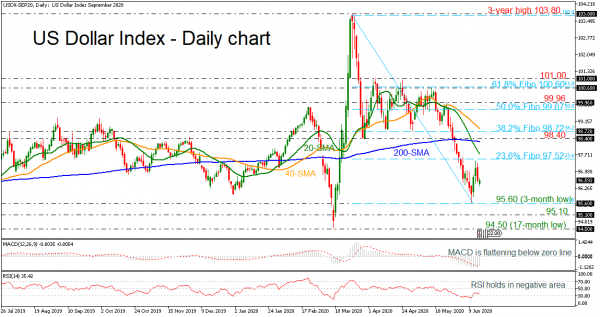

The US dollar index touched the 23.6% Fibonacci retracement level of the down leg from 103.80 to 95.60 at 97.52 and retreated lower, heading towards the three-month low. The MACD is flattening below the trigger and zero lines, while the RSI is sloping down in the negative zone in the short-term. Also, the 20-day simple moving average (SMA) created a bearish crossover with the 40- and 200-day SMAs.

A continuation of the bearish structure could open the door for the three-month low of 95.60 and the 95.10 support line. More losses could send prices towards the 17-month trough of 94.50.

On the other hand, if there is a rebound, immediate support could be appeared near the 23.6% Fibonacci of 97.52 ahead of the 97.75, that being the 20-day SMA. Above this hurdle, the 200-day SMA could come into the spotlight, standing slightly below the 98.40 resistance, while the 38.2% Fibonacci of 98.72 seems to be a crucial resistance level.

In brief, the US dollar index has been in a falling mode over the last three months, after the drop below the 98.72 barrier.