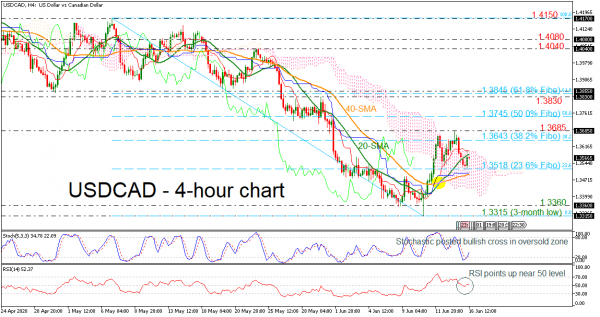

USDCAD is trading around the vicinity of 1.3575, that being the 20-period simple moving average (SMA) after the rebound on the 23.6% Fibonacci retracement level of the bearish move from 1.4170 to 1.3315 at 1.3518.

Looking to the short-term oscillators, the stochastic and the RSI promote slight improvements, despite diminished directional momentum. The stochastic is creating a bullish crossover within the %K and %D lines in the oversold zone, while the RSI is sloping north near the 50 level. Also, the 20- and 40-period SMAs completed a positive cross in the preceding sessions.

Should buyers drive the pair above the 20-period SMA and the upper surface of the Ichimoku cloud, they could encounter initial strengthened resistance from the 38.2% Fibo of 1.3643 and the 1.3685 barrier. A step above may meet further constrictions from the 50.0% Fibo of 1.3745.

Otherwise, if sellers take control, initial support could come from the 23.6% Fibo of 1.3518 and the 40-period SMA at 1.3493. Diving further, immediate limitations may arise from the lower surface of the cloud currently around the 1.3400 psychological level. If the bears persist, the attention could then move towards the 1.3360 hurdle, identified by the trough on June 8 and the three-month low of 1.3315.

All in all, the very short-term timeframe sustains a neutral mode for now. However, a break above 1.3685 could reveal the next direction.