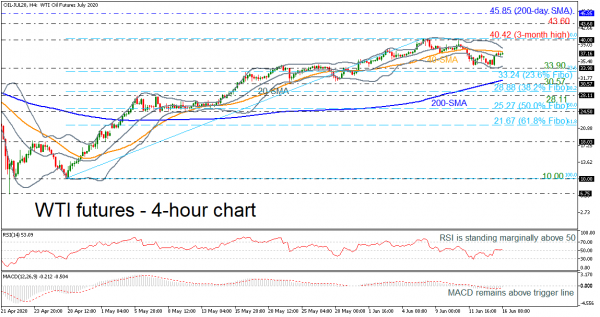

WTI oil futures over the last few sessions – as positive momentum evaporated – were unable to decisively overrun the 40-period simple moving average (SMA), remaining within the squeezed Bollinger bands that are suggesting an aggressive move if there is an exit of the channel.

The short-term oscillators suggest a neutral mode for now. The MACD, in the negative region, has jumped above its red trigger line, while the rising RSI has just moved above its neutral mark. That said, the move within the 20- and 40-period SMAs suggest a weak market in the very short-term.

If buyers push above the moving averages, initial resistance could come from the upper Bollinger band around 38.32 ahead of the 40.00 handle and the three-month peak of 40.42. Climbing higher, 43.60, identified by the inside swing low on March 2 could interrupt the test of a key region from the 200-period SMA in the daily chart.

To the downside, immediate support could come from the lower Bollinger band and the 33.90 barrier. Moving marginally lower, the 33.24 level, being the 23.6% Fibonacci retracement of the upward wave from 10.00 to 40.42 could be revisited. The next hurdles could come at 31.37, which is the 200-period SMA in the 4-hour chart, before touching 30.57 and the 38.2% Fibonacci of 28.88. Even lower, the 28.11 mark and the 50.0% Fibonacci of 25.27 could come in focus as well.

Summarizing, the very short-term bias has turned neutral but if the price shifts above the 40.42 roof, the picture could turn positive again.