Key Highlights

- EUR/USD traded to a new 2-month high at 1.1422 before correcting lower.

- There was a break below a major bullish trend line at 1.1320 on the 4-hours chart.

- GBP/USD also corrected lower sharply after trading above the 1.2800 level.

- The UK GDP posted a sharp decline of 20.4% in April 2020 (MoM).

EUR/USD Technical Analysis

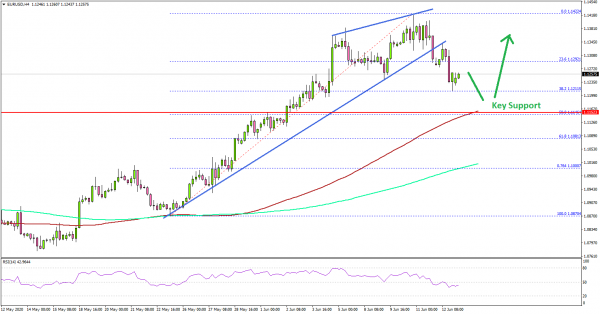

In the past few days, the Euro gained bullish momentum above the 1.1200 resistance against the US Dollar. EUR/USD broke many hurdles and traded to a new 2-month high at 1.1422.

Looking at the 4-hours chart, the pair started a sharp downside correction from the 1.1422 high. It broke the 1.1350 and 1.1320 support levels to start the current correction wave.

Moreover, there was a break below a major bullish trend line at 1.1320. The pair tested the 1.1210 level or the 38.2% Fib retracement level of the upward move from the 1.0870 low to 1.1422 high.

On the downside, there are many key supports, starting with 1.1200. The main support is seen near the 1.1150 level and the 100 simple moving average (red, 4-hours). The 50% Fib retracement level of the upward move from the 1.0870 low to 1.1422 high is also near 1.1146.

Any further losses could lead EUR/USD towards the 1.1000 support zone or the 200 simple moving average (green, 4-hours).

Conversely, the pair could start a fresh increase from 1.1200 or 1.1150. On the upside, the first key resistance is near the 1.1350 level. If EUR/USD closes above the 1.1350 level, it could revisit the 1.1400 level in the near term.

Looking at GBP/USD, the pair rallied above the 1.2700 level, but it failed to stay above 1.2800 and started a sharp downside correction below 1.2650. Besides, USD/JPY corrected higher, but it is facing many hurdles near 108.00.

Upcoming Economic Releases

- Euro Zone Trade Balance April 2020 (s.a.) – Forecast €22.9B versus €23.5B previous.