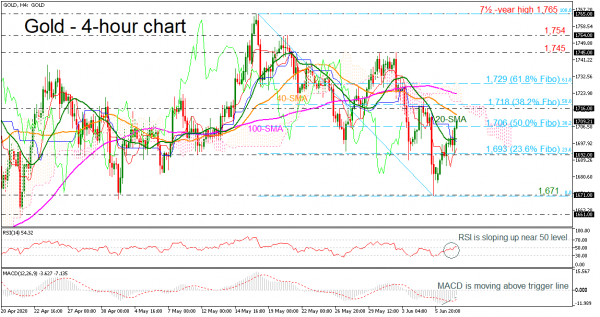

Gold is extending its positive momentum following the bounce off the 1,671 support level, having surpassed the 20-period simple moving average (SMA) in the 4-hour chart. However, the structure in the short-term remains bearish despite the latest upside correction.

In momentum indicators, the RSI is pointing up near its neutral threshold of 50, while the MACD oscillator has posted a bullish cross with its trigger line in the negative territory.

Should gold challenge more levels to the upside, immediate resistance could come from the 40-period SMA at 1,713. Clearing this line, the 1,716 and 1,718 barriers, including the 38.2% Fibonacci retracement level of the down leg from 1,765 to 1,671 could attract investors’ attention ahead of the 100-period SMA, currently at 1,724. More upside pressures could hit the 61.8% Fibonacci at 1,729, which coincides with the upper surface of the Ichimoku cloud.

On the flip side, a drop below the 20-period SMA could move the market towards the 23.6% Fibonacci at 1,693, which overlaps with the red Tenkan-sen line. A close below this level could pressure the price until the 1,671 low, registered on June 5 and the 1,661 support from April 21.

In brief, the yellow metal is in the process of an upside correction in the very short-term, but the outlook continues to hold bearish since May 18.