Key Highlights

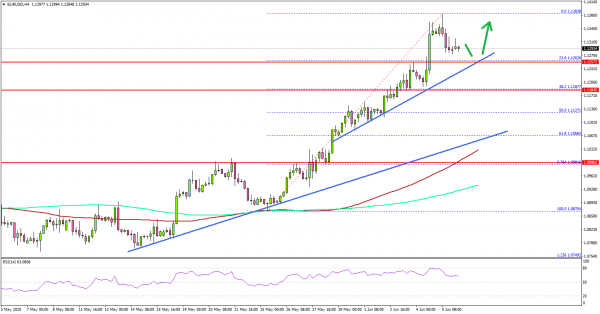

- EUR/USD surges to a new monthly high at 1.1383 before correcting lower.

- A key bullish trend line is forming with support near 1.1250 on the 4-hours chart.

- The US nonfarm payrolls increased 2,509K in May 2020, whereas the forecast was -8,000K.

- The Euro Zone Sentix Investor Confidence could decline from -41.8 to -56.3 in June 2020.

EUR/USD Technical Analysis

This past week, the Euro started a strong increase above the 1.1200 resistance against the US Dollar. EUR/USD rallied more than 200 pips and traded close to 1.1400.

Looking at the 4-hours chart, the pair traded to a new monthly high at 1.1383 and settled nicely above the 100 simple moving average (red, 4-hours) and the 200 simple moving average (green, 4-hours).

Recently, it started a downside correction and traded below the 1.1320 support. An initial support on the downside is near the 1.1260 level. It is close to the 23.6% Fib retracement level of the upward move from the 1.0870 low to 1.1383 high.

Moreover, there is a key bullish trend line forming with support near 1.1250 on the same chart. If the pair breaks the trend line support, there could be a sharp decline towards the 1.1200 support.

The next major support is near the 1.1120 level or the 50% Fib retracement level of the upward move from the 1.0870 low to 1.1383 high. On the upside, the pair is likely to face a strong selling interest near the 1.1350 and 1.1380 levels.

Fundamentally, the nonfarm payrolls report for May 2020 was released by the US Bureau of Labor Statistics. The market was looking for a decline of around 8,000K.

The actual result was positive, as the total nonfarm payroll employment increased 2,509K. Besides, the unemployment rate improved from 14.7% to 13.3%.

The report added:

These improvements in the labor market reflected a limited resumption of economic activity that had been curtailed in March and April due to the coronavirus (COVID-19) pandemic and efforts to contain it. In May, employment rose sharply in leisure and hospitality, construction, education and health services, and retail trade. By contrast, employment in government continued to decline sharply.

Overall, EUR/USD might correct lower, but the 1.1200 support holds the key. Looking at USD/JPY, there was a sharp increase above the 108.80 and 109.00 resistance levels.

Upcoming Economic Releases

- Germany’s Industrial Production for April 2020 (MoM) – Forecast -15.5%, versus -9.2% previous.

- Euro Zone Sentix Investor Confidence for June 2020 – Forecast -56.3, versus -41.8 previous.