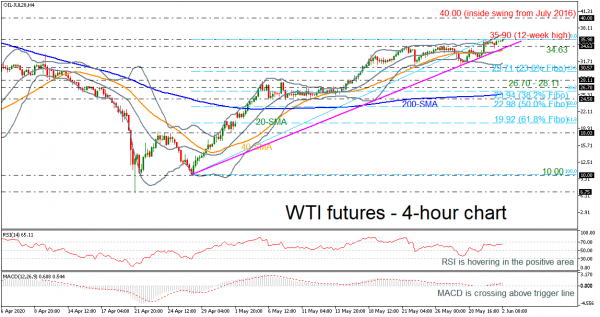

WTI crude oil futures for July delivery have been moving slightly higher on the four-hour chart since the soft rebound on the ascending trend line at 30.57 which has been holding since April 28. Over last couple of days, the commodity is trading sideways, finding resistance near the 12-week high of 35.90 and the upper Bollinger band.

In the short-term, the market could maintain its consolidation phase if the RSI keeps moving around 50, and the 20- and 40-period simple moving averages (SMAs) hold flat. However, the MACD continues to stand above the trigger line in the bullish territory, keeping upside risks alive.

An extension to the upside and above the 35.90 key level could meet the 40.00 round number, identified by the inside swing low on July 2016. Further up, resistance could run towards the 43.60 level, registered on December 2018.

On the other hand, if oil weakens, the 34.63 mark which overlaps with the 20- and 40-period simple moving averages (SMAs) near 33.90 could provide immediate support ahead of the rising line. Even lower, the lower Bollinger band at 31.33 could attract a greater attention as any leg lower could switch market’s bullish outlook to neutral, opening the way towards the 23.6% Fibonacci retracement level of the upward wave from 10.00 to 35.90 at 29.71. More losses could open the door for the 26.70 – 28.11 support zone.

In short, the bullish sentiment deteriorated over the past month after the upward rally from the 10.00 trough peaked at 35.90. A move above that top could now help the market to extend the positive picture.