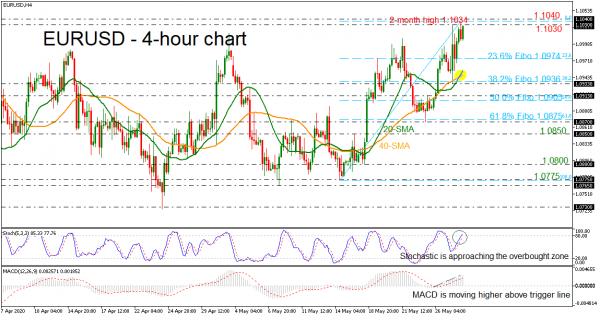

EURUSD has been rising over the last two weeks, challenging a fresh almost two-month high at 1.1034. The bullish picture in the short-term is further supported by the MACD, which is edging higher and above its red trigger line, while the stochastic is heading towards the overbought zone with weaker momentum than before. The 20- and 40-period simple moving averages (SMAs) posted a bullish crossover, indicating more gains in the foreseeable future.

The next resistance area to have in mind is the 1.1030 – 1.1040 before extending the bullish sentiment towards the 1.1145 barrier.

Should prices reverse lower, support could emerge around the 23.6% Fibonacci retracement level of the upward wave from 1.0775 to 1.1034 at 1.0974. Below that, the bullish cross of the SMAs could attract attention within 1.0945 – 1.0955 ahead of the 1.0936 support being the 38.2% Fibonacci mark. A drop below this area would take the price until the 50.0% Fibonacci of 1.0905, which stands slightly below the 1.0913 inside swing high from May 25.

Overall, EURUSD penetrated the roof of 1.1015 and is extending its gains, suggesting a potential positive picture in the short- and medium-term timeframes. A successful rally towards 1.1145 also adds optimism for brighter outlook.